2021 GonzoBanker Awards

“Accomplishing the impossible only means that it will get added to your regular duties.” –Doug Larson

Gonzo readers, 2021 was just plain schizophrenic. It was a very mixed year in terms of change, expectations, and results. Covid was supposed to be controlled, except it wasn’t. It accelerated the customer move to digital and the employees’ move to some kind of work-at-home arrangement, at least in part. We know the change is permanent, but we can’t yet see exactly what it will all look like.

A few years ago, very few people would have guessed that tens of billions of dollars would be invested in fintech vendors and solutions annually – except it happened. 2021 fintech investments, merger activities, and overall focus were off the charts. We know the customer buying and use of financial services is being fundamentally changed by fintech, but our long-term strategies to invest/partner/buy/compete are very much works in progress.

Interest rates probably should have returned to more normal historical levels – except they didn’t. And all of this made margin and fee income compression a given in planning the future business model. Making 5-year planning assumptions can feel like throwing the bones in Vegas.

But in the midst of all of this schizophrenia, guess what our Troublemaker financial institutions did?

Answer: they made progress. Digital and payments plans were developed, investments are being made, and transformation projects are being executed. Customer satisfaction and trust in financial institutions is strong. Credit quality is strong – still. Profitability, even with all these challenges, is strong. Confidence and team morale are strong. Our clients have an amazing ability to get things done in trying circumstances, and we are second to nobody in our admiration for what you accomplished.

So, we have two things to add to the to-do list. One, we don’t know who is going to spike the nog and the Christmas muffins or what they will spike it with, but we know this is a good thing and your job is to take a moment to partake. Two, read and enjoy the 2021 GonzoBanker awards, our annual take on the best things we saw during the year.

Then right back to the impossible in 2022. The phrase we get back to most when discussing our troublemaker FIs is “battle ready.” We can’t wait to see next year’s successes.

THE BANKER AWARDS

Bank Deal of the Year

It was a cray cray year for mergers and acquisitions (M&As) in 2021 coming out of COVID slowdown in 2020. With prices rational and revenue pinched, there were some nice acquisitions by many banks. However, we had to give the best acquisition award to U.S. Bancorp for grabbing MUFG Union Bank. Union has been a stalwart of the California marketplace since the ’50s, and this gives Andy Cecere and team a great expansion into the Golden State and also some nice wholesale banking business. Lots of tech and operations to clean up, it appears, but no solid bank is better qualified than the team from Minneapolis.

Acronym of the Year

Has to be M-O-E. The merger of equals activity in 2021 was sky high, primarily because banks with pinched margins from low rates worked to grabbed scale. From nowhere, sizable regional players are being created.

Bank Merger of the Year

So which merger was the best in 2021? That’s almost impossible to select. Some interesting finalists would be:

- M&T and People’s United

- Old National and First Midwest

- Webster and Sterling

- Columbia Bank and Umpqua

All have great potential. If we had to pick one by a nose, it would go to…

Huntington and TCF merge to create the $170 billion Midwest dynamo and vault them into one of the top 10 banks in the country. The most important aspect of this deal is Huntington. This is an innovation-seeking franchise that has built a solid brand and never got over its skis in execution. A deal like this has huge integration risk, and it’s good to have Stephen Steinour and team leading the way.

Sidenote: The Economics-Are-as-Sexy-as-Disco award goes to John Augustine of Huntington Bank with this quote: “We’re in the first negative real yield environment since the 1970s.”

Credit Union Merger of the Year

CAP COM and SEFCU in New York come to together to create an $8 billion cooperative organization. MOEs like this are rare in the credit union industry, but we expect with continued demands for scale there will be more.

Best Fintech Acquisition by a Bank

Fifth Third Bank’s August acquisition of digital healthcare platform Provide (purchase price not disclosed). The deal demonstrated both an emergence of banks acquiring fintechs and – in the spirit of City National’s prior acquisitions of Exactuals and Filmtrack in the entertainment industry – a niche industry focus on healthcare practices.

Honorable mention goes to MVB Financial’s acquisition of Trabian where MVB expands upon its focus on serving fintech through Trabian, a firm well known for the software development work that connects and develops from existing apps while also acting as acqui-hire picking up Trabian leader Matt Dean for to help MVB’s ventures.

Fintech Acquiring Bank

SoFi’s March acquisition of Golden Pacific Bancorp for $22.3 million gets the vaunted consumer lender a much-prized bank charter, low-cost deposits to juice current earnings, and a business lending capability to drive future growth.

Honorable mention goes to BM Technologies’ acquisition of Seattle’s First Sound Bank with BankMobile co-founder Luvleen Sidhu creating what will be BMTX Bank and pointing to how two small organizations can come together to – as she put it at KBW’s December Innovation in Finance conference – end the partnership “pain in the butt” of two organizations needing to share both revenue and the same compliance beliefs.

GonzoBanker of the Year – Bank

There are lots of entrepreneurial leaders in the banking space today, but this year the nod goes to Randy Chesler at Glacier Bancorp. For the past four-plus years, Chesler has guided Glacier through continued growth and successful acquisitions across the West, all while staying true to Glacier’s local market culture. Performance and multiples continue to be solid, outperforming most regional banks. Congrats to Randy and a great management team.

GonzoBanker of the Year – Credit Union

We have to give the nod here to Jim Hayes, who was selected by $50 billion State Employees Credit Union to become the new CEO, the first outsider in eons. After leading a great and vibrant organization at Andrews Federal Credit Union, Jim and his family have taken on a new adventure, and the Gonzo team is confident Jim’s ambition and transparent leadership style will be welcome in Raleigh, N.C. Congrats on a brave move and national recognition Jim!

The Bank That Gets Fintech

Goes to Larry Mazza and the crew at MVB Bank in West Virginia. Based on a clearly defined strategy, this team has established a dedicated fintech group that offers services ranging from BaaS to sponsoring card issuance and lending, to providing crypto services, to offering niche partnerships to the gaming industry. Partnerships have been established with household names such as FanDuel, DraftKings BetMGM, and Credit Karma. Simultaneously the bank invested in Paladin Fraud, Trabian Technology, and Chartwell Compliance to provide compliance and risk management solutions in the complex and connected web of fintech partnerships.

If that is not enough, the bank established MVB Edge Ventures and now has equity positions in Flexia Payments, Grand and Victor – all of which are embedding payments, banking, and risk management services in new ways. Has it worked? Since 2017, ROAE has grown from 7% to approximately 20% and ROAA has increased from .82% to over 2.3% in the most recent quarter while assets have doubled to nearly $3 billion. Simple? No. Inspirational? You tell us.

The CEO Who Gets BaaS

Goes to Eric Sprink, Coastal Community Bank, Everett, Wash. Eric has always been a student of innovation, and now at Coastal, this fearless leader has spearheaded a number of high-profile banking-as-a-service partnerships. Today, the industry flocks to Sprink for his insights and opinions about this nascent segment of the industry.

Lifetime Leadership Achievement Awards

We have to recognize some great executives who hung up the pinstripes to move on to more fun adventures in 2021.

- Randy Stevens, CEO, First Farmers and Merchants Bank, Nashville TN. Stevens is amazing in this day and age to have worked for the same bank for 50 years, leading up to his great run as a CEO. Through all this, First Farmers has remained disciplined in performance and squarely focused on customers and community. Hats off to a legacy Randy.

- Doug Fecher, President and CEO,Wright-Patt Credit Union – In a 21-year solid leadership run, Doug led the growth of Wright-Patt from $600 million to $6.8 billion. He built a culture of collaboration, innovation and obsessive focus on the credit union’s members, all while being one heck of a player in a rock band. Enjoy the encore of retirement Doug – you killed it.

- Mike Kloiber, President/CEO,Tinker FCU. In his 25-year run as CEO, Mike took Tinker Federal from $1 billion to $5 billion while creating amazing solutions for the credit union in financial education and building an impactful foundation. Mike never wavered from the true mission of the credit union and demonstrated the humble daily fight to do right by every man and woman. What a career. We know Mike and his wife Pam will continue to support their causes supporting our nation’s finest who serve in the military, and for those in need in the community.

In Remembrance

The Gonzo team remembers some of the great souls we saw pass in 2021:

- John “Jack” Grundhofer, former U.S. Bancorp chairman. Famous for turning around a bank to create the foundation for powerful U.S. Bancorp, Jack will always be remembered for his no B.S. style and clear focus on performance and accountability. Having a competitor like Jack around made all bankers want to perform better.

- Chuck Snyder, chief executive of National Cooperative Bank (NCB). Chuck was loved by all around him and regarded as the supporter and hero of housing cooperatives. Chuck was a values-based leader who quietly worked wonders for decades and never wavered from NCB’s mission and purpose.

- Brandon Dewitt, MX co-founder and chief technology officer. The banking industry lost a giant in November when Brandon died after a five-year battle with cancer. That the battle was only expected to last three months is testament to Brandon’s strength, perseverance, and ingenuity during his treatment. Brandon personified “purpose-driven.” In a recent episode of the Breaking Banks podcast, Brandon commented: “With each new layer of technology you bring in, technology has been optimizing and automating everything out there. There’s now a new layer of stewardship. Like how does that play into our communities? How do we set the right priorities and have the right types of purposes behind that? You have to decide: are you going to be a builder and executor, or will you be a handshake entrepreneur?” RIP, Brandon Dewitt.

- Tom Sargent, CEO, First Technology Credit Union. Tom led First Tech for 25 years and always had a passion for credit union members and the opportunity to innovate financial services. The Cornerstone team is hoping Tom is playing fantasy baseball with some New York Yankee legends in heaven this holiday season. What a life and what a person to have known.

- Rex Johnson, Baxter Credit Union founder and former CEO – Rex was a legend in the credit union industry who will always be remembered as the “Yoda” of lending. So many credit union executives were mentored by Rex it’s hard to count. We salute a legend of lending and credit union leadership.

- Michael Besselievre, banker and Cornerstone team member – The Cornerstone team lost a great banker and former team member this year. Michael was a smart, gritty banker with a heart of gold. He could take on almost any project at Cornerstone without fear and we were honored by the work he did for our firm.

THE INDUSTRY TREND AWARDS

The Inevitability Award Goes to Disappearing Overdraft Fee Income

The regulator and media pressure on overdraft fees has been a constant challenge to overdraft revenue. While many consumers would prefer transactions to be approved and not be embarrassed at the point of sale, the ongoing regulatory and media environment makes ODP’s long-term viability tenuous. With large banks, including Ally and Capital One, officially doing away with overdraft fees, banks and credit unions will have to decide how they want to handle the new reality. ODP revenue will drop significantly if not go away completely. Allowing consumer transactions to process without large fees will become the standard. Chime does this already with its SpotMe tool, which allows up to $200 in debit transactions without overdraft fees. A willingness of others to do things for lower or no fees eliminates the ability to charge for the service. Banks need to be prepared for the inevitability of this revenue impact and find ways to continue serving these customers.

Payments Game Changer of the Year

Amazon will accept Venmo beginning in 2022. This move is the first significant noncard payment option on the Amazon platform, bringing a loyal 60 million users to the virtual checkout line. With Venmo charging 100-150bp less than the card networks, merchants will aggressively follow Amazon. For years, stock analysts peppered PayPal with the question, “When will you monetize Venmo?” As Cornerstone’s payments guru Tony DeSanctis concludes, “Well, that moment seems to have arrived.”

The Love It/Hate It/Can’t Stop Talking About It Award: BNPL

Depending on your perspective, you may think that buy now pay later (BNPL) is a dangerous new lending product or a brilliant innovation in customer acquisition and closed loop payments. It’s unlikely, however, that you don’t have an opinion on BNPL, one way or the other. And, after a year in which Affirm went public and Afterpay was acquired by Square and Klarna was valued at $45 billion and U.S. consumer spending through BNPL is projected by Cornerstone to increase from $24 billion to nearly $100 billion, it’s impossible that you haven’t heard of BNPL. Love it or hate it, we can all agree that 2021 was the year no one could stop talking about BNPL.

Stop the Madness Award goes to the credit memo

Imagine a bright college graduate steeped in data science and process automation starting a new job at a bank and the first meeting is spent arguing with a vendor about the format of the credit memo. How can the banking industry compete for future talent while focused on memos?

“This Ain’t Lip Service” Award goes to DEI

“Diversity is coming up on earnings calls. You can lose talent over this.” –Plinqit founder Kathleen Craig and panel at AFT Fall Summit

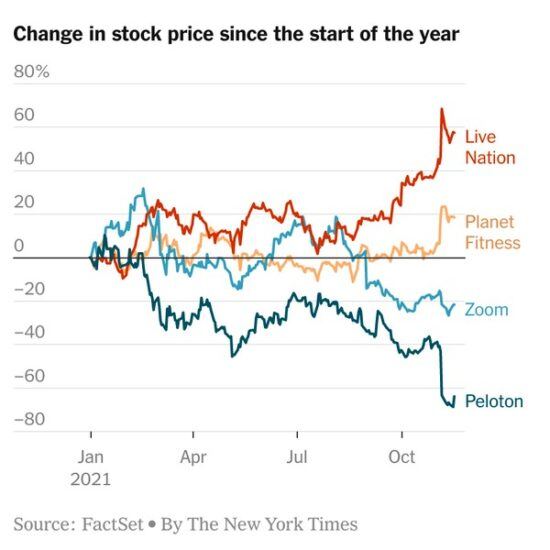

Pandemic-May-Be-Easing Visual-of-the-Year

THE TECHNOLOGY AWARDS

Technology of the Year

Goes to everything around “Cryptofication” in 2021. We aren’t talking just Bitcoin or Ethereum. 2021 was the year banks that had been bemused observers of crypto realized that the blockchain virus was beginning to infect mainstream financial services. As regulators grappled with new policy, Congress pondered taxing crypto, and bankers began pilots to offer crypto currency conversion, the industry quickly realized that this alternative currency paradigm is here to stay and must be integrated into future strategy and client experience. It may have started with the hackers and moved to the Robinhood amateur traders, but now crypto is squarely on the plate of us old fart bankers.

Frothy Valuation That Would Make Elon Jealous Award

Goes to BREX with a $12.3B valuation in October. While BREX doesn’t disclose revenues, we believe it to be no higher than $200M, which would be a 60X+ revenue multiple. Also, Visa acquired Tink in 2021 for a multiple near that.

The Stock to Own in 2021

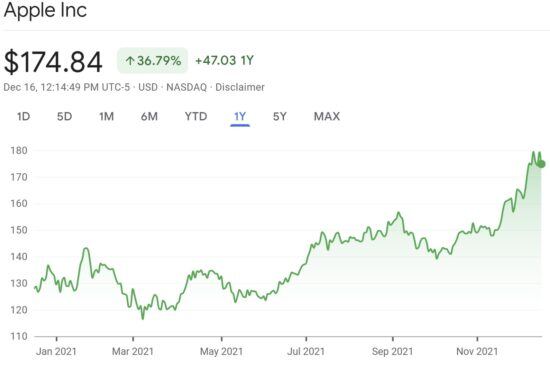

Well Covid survivors, in 2020 it was Zoom, but now as we switch from sweatpants to office-acceptable slacks, this year’s winner has to be Apple. Just a few years ago, Apple was the first company to reach a $1 trillion market cap, yet (watch your jaw) today the company is knocking on the door of a staggering $3 trillion market cap. Tim Cook and team keep many of us addicted to simple, elegant, and integrated in an ecosystem.

Vacuous Rebranding of the Year Award

Facebook-to-Meta, Square-to-Block, and Marcus-by-Goldman-Sachs which rebranded to – wait for it … Goldman Sachs Marcus

The Pound-the-Unsubscribe-Button Award

Goes to the company – you know who you are – that sent one of our consultants a “Thank you for joining our newsletter” email (but the consultant had never joined) with a note at the bottom indicating that the company knew the consultant had never joined, but instead had been identified as a person who might like to collaborate. Ahem. FYI, collaboration means interested parties acting in good faith.

Be Careful What You Believe Award

Goes to the growing cacophony of low-code and no-code software promises in the bank tech market. These tools are great steps forward, but techies and bankers should be cautious about plug and play promises. These platforms always end up needing a staff of programmers and analysts for care and feeding on an ongoing basis.

There is No Universal Business Adapter Award

Goes to a similar promise with application programming interfaces (APIs) and enterprise service buses (ESBs). Again, great tools but none of this eliminates the need to contextually understand, design, and execute business process and line of data logic. Remember this great IBM commercial from early in the century?

THE VENDOR AWARDS

Bank Core Deal of the Year

It was a big year for both traditional and next gen core vendor wins, but Fifth Third Bank’s deal with FIS Modern Banking Platform had a level of gravitas that no other deal had. Coming right on the heels of the BMO announcement and 18 months after the Union announcement, this deal cemented MBP as the leader in next gen banking cores for traditional U.S. banks; stole the limelight away from Nymbus, FinXact, and others nipping at the Big 3’s heels; and pigeonholed Fiserv and Jack Henry as your grandpa’s core vendor. Yeah, yeah, we get it. MBP isn’t ready for prime time, conversion is years away, Fifth Third was already an FIS Systematics customer, and Thought Machine came out of nowhere later in the year. But this was a huge endorsement of FIS’ core modernization strategy, of Code Connect as an emerging API superstar, and of Commercial Express as a proof point that next gen cores aren’t just for retail banking. Now, about that execution…

Credit Union Core Deal of the Year

Fiserv DNA continues to rack up successes in large credit unions, savings banks, and even a few regional commercial banks. Its win at $9 billion, soon to blow past $10B, OnPoint Community Credit Union is our credit union core deal of the year because the execs at OnPoint committed to a true process and technology transformation and not just the traditional, rip and replace core conversion that is still far too common amongst the larger credit unions and regional banks. After a hefty process improvement effort and thorough vendor due diligence, DNA, with many Fiserv surrounds, was selected to power the CU’s transformation and set it up to be nimbler in the future. A big win for Fiserv DNA. Though, after losing two of its five largest installs, it raises questions about whether the remaining large CUs on Fiserv XP2 will start to bolt, too.

Pool Shark Run the Table Award

Goes to NYDIG – which almost overnight became the partner of choice for financial institutions and vendors as the gateway between “fiat” and crypto. The number of vendors and financial institutions talking about implementations with NYDIG in only 12 months is pretty darn bind moggling.

The Core Transformation Shot Across the Bow Award

Chase and Thought Machine for their brow-raising announcement of a core transformation partnership. For Thought Machine to win a deal with regional bank Arvest and national leader Chase in one year is impressive. The latest tech thinking will now be brought to the land of COBOL core. However, for the innovative non-bankers bringing the Vault platform with cloud-native, smart contract capabilities, get ready for the ugly world of U.S. regulated financial institutions!

The Next Gen Tech Evangelist Award

Goes to Jeffery Kendall and the team and Nymbus. The conversations driven by Nymbus and team have been provocative and forward-looking. From building an innovation lab, to working with fintech and BaaS providers to starting a new CU core CUSO, this team has been very busy provoking the market with the message, “Let’s all try to move faster!”

Bank Digital Deal of the Year

Goes to FIS for its double play Digital 1 and modern core deal with BMO Harris. There are a lot of eyes on FIS’ new tech strategies and how execution will go. This is a nice marquee win for FIS.

Credit Union Digital Deal of the Year

Goes to Lumin Digital for its big win with BCU in Chicago, a highly progressive looking to differentiate through experience even more.

The Digital New Kids on the Block Award

Goes to the trio of Lumin Digital, Mahalo, and Narmi, which continues to attract interest in competitions with the majors. Banks and credit unions are considering all options and looking for innovation because strategically, they simply must get digital right.

Man That’s a Cruddy Market

Goes to the limited solutions vying for leadership in the consumer loan origination tech market. Man, this is the bread and butter of retail banking and credit unions. This is the age of digital lending. This is the age of alternative credit data, AI and robotic automation. Let’s heat things up, fintechs – there’s an opportunity awaiting.

The Alanis Morissette You Oughta Know Award

Goes to the vendor that was presenting a glowing video from a reference client at a new prospect, while at the same time, the reference client in the video was in a demo for a competitive core.

The Tom Hanks Achievement in Excellence Award

Goes to Corelation’s Brent Edwards, 2021 winner the Golden Cufflinks. Brent continues to hone his craft with each demo. He never mistakes his role for being the sales lead and instead focuses on presenting the system. We’ve never heard him say “absolutely” in response to a client question, relying instead on demoing his response.

The Eurythmics “Would I Lie to You” Award

Goes to the vendor rep that opened a demo session by stating, “We’re only going to show you features and solutions that are in production and in your proposal,” then promptly started demoing a system that was not in production nor in the proposal.

Distant Third Place with Street Vendors Award

Goes to Zelle from this San Francisco Giants game street vendor. Note Zelle is the only option without a quick QR code.

THE SMARTER BANK AWARDS

Smarter Bank Business Model

Every year, Cornerstone salutes the “smarter banks” that are modernizing their business and growing in focused and strategic ways. Let salute this year’s standouts:

- The Strategy Award – Goes to Titan Bank and CEO Jonathan Morris. Even amongst the impressive group of entrepreneurial, fintech-forward bank CEOs, Jonathan stands out. Before getting into banking, he started two tech companies in Asia and was a consultant at Boston Consulting Group. In 2007, he entered banking by investing in Titan Bank, a $100 million, 114 year old bank in Mineral Wells, Texas – population 15,000 and declining. Since then, he helped create the model for Lending Club, built a nationwide SBA and USDA Rural Development lending machine, and built a profitable crypto line of business. Titan Bank is now $500 million in assets posting an eye popping 57% ROE based on a fee generating model that drives 51% of its income from noninterest income. For those counting at home, 25% noninterest income as a % of revenue has been the best in class target for years. His next venture? Productizing an internally developed commercial deposit account opening platform that can open multiple business accounts in minutes by nailing the Achilles heel of business DAO – KYC and beneficial ownership. No doubt Jonathan will continue to push his vendors, competitors, and consultants to try and keep up.

- The Data Award – Goes to Suncoast Credit Union, Tampa, Fla. While many FIs want to transform data into information to drive more data-driven-decisions but struggle to find where the initiative fits in the strategic plan, Suncoast has a maturing analytics team leading the way. Suncoast optimized its overdraft program based on member deposit engagement, which helped to reduce losses and improve member service; generated industry-leading digital loan growth; and has implemented a cloud-based data lake. Together, Suncoast’s people, processes, and platforms fuel service, growth, and informational differentiation.

- The Customer Experience Award – Goes to Capital One for moving fleet-footed to react to the new realities of retail banking. Once known for high-yield money market accounts, Capital One is not leaving customer experience to the neobank realm. With the power of great advertising about five-minute digital checking account openings, new post-Covid cards products, eliminating ODP and cop-ting Chime’s “get paid early” promise, the team at Capital One has increased transaction account balances of roughly 260% in the first nine months of 2021. Enough said?

- The Technology Award – Goes to Synovus Bancorp. Zack Bishop and Matthew Maxey have led the way with their Bank of Tomorrow initiative, setting legacy technology to the side and building a new tech stack to carry the industry forward!

- The Ecosystem Award – Goes to BCU for its continued engagement in a small group of strategic partners such as Salesforce, Jack Henry, Blend, and now Lumin Digital to scale the organization smartly. BCU does the hard work of aligning strategy with technology and their member experience, and instead of complaining about vendors they engage with partners on the gritty details of best practice execution.

- The Talent Award – Goes to Alerus Financial. President/CEO Randy Newman and team have shown a strong, consistent commitment to developing talent, achieving diversity, and encouraging team members to be innovative and forward leaning. The result has been a modern, diversified financial organization focused on the long-term wellness of clients, team members, and communities.

Yes Bankers … Covid is Over … or Not … or What?

This year changed us all. From the great resignation to vaccine mandates to a new glimpse of inflation, 2021 was a year when we realized that our mindset has to simply get used to surprises, to veers in the road and to resiliency.

Everyone’s tired, but everyone held on and performed. Bankers should be proud of that. There’s a new generation of voices wanting to paint our industry as “fat cats,” but the truth is, Cornerstone’s clients are full of hard-working, gritty bankers who care about customers, community, team members, and living with integrity. The bankers who waver into bad behavior and surrender integrity are the .001%. Believe it, because we see it every day in our work with financial institutions across 50 states.

With the trends around digital, fintech, embedded finance, and BaaS, bankers clearly recognized in 2021 that we’re not ready for disruption. We are absorbing it quickly, but we’re frustrated that we are moving too slowly. The message from the Cornerstone team is this: keep going. All this gloss around you must be addressed, but some of the froth will eventually come down to earth. A world full of sky-high valuations seeking exit with little focus on earnings will come down to earth. An explosion of asset values fueled by printing money will come down to earth. A promise that computer code will replace everything done in banking will come down to earth.

We have no choice, bankers, but to accept that every disruptive trend around us is a warning sign about our relevancy. We have to modernize, scale, be more entrepreneurial, and get moving. But along the way, let’s remember that being sincerely customer focused, building a great team of talent, managing risk with a long-term view, and engaging communities will never, ever go out of style.

Be ready with your “A game” when the froth comes down to earth, GonzoBankers, and, for now – peace on Earth, good will towards all. Happy Holidays!

As you begin the new year, keep Cornerstone Advisors’ 140 banking professionals in mind to help you set a clear vision for the future, transform, and achieve high performance.

The Perfect Hotel for GonzoBankers

The Gonzo Inn in Moab, Utah!