COVID-19: Real Trends and Stories From the Front Line

Banks and credit unions report the pandemic’s impact on customer behavior.

There have been all sorts of discussions about the impact of COVID-19 on branches, customers and banking activity. At Cornerstone, we had a novel idea: instead of people like us droning on about what’s happening at financial institutions, why not hear what bankers who are living this every day at the front line have to say?

Last week we asked 14 clients to complete a quick survey to let us know what they are seeing. The survey was not intended to withstand the data or validity test of normal surveys. Instead, we wanted to get a feel for what successful bankers are experiencing with their customers and members.

We asked bankers to provide us with two specific measurements:

1) The change in customer behavior since COVID-19 in eight key areas, and

2) The percentage of this change that is likely to be permanent (versus returning to pre-COVID-19 numbers).

Here’s what we heard:

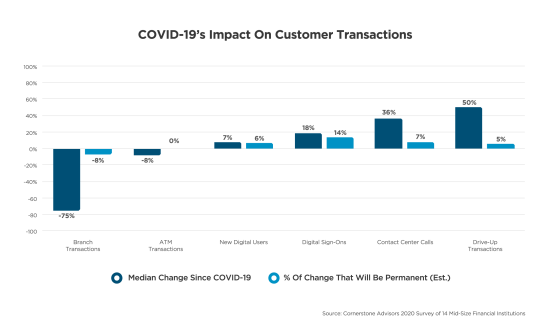

1. Branch servicing transactions have dropped significantly.

The median transaction count reduction was 75%, with the lowest drop being 36% and the highest 90%.

This is probably the least surprising answer we received. All but one of the respondents closed lobbies to walk-in traffic and moved to appointment-only banking. While it is still early to get detailed numbers, most everybody felt that customers are just doing fewer transactions, just like they are making fewer visits to the supermarket or the gas station. One note: about half of the FIs had temporarily reduced branch hours.

When asked to estimate how much of the change they think will be permanent, most said between 10% and 20%. This comment seemed to mirror the general sentiment: “Although lobby traffic will be slow to recover, this trend will not be permanent. Customers will welcome the chance to do business in person again when it is safe to do so.”

Another take: “Despite all the ways to conduct transactions – online, ATM, contact center – we still saw some very long lines in our drive-ups (especially when EIP payments were sent). For this reason, I think we will still see a fair amount of the branch activity return, although it will not reach pre-COVID-19 levels for a while, if ever.”

2. Branch drive-up transactions increased – in some cases significantly.

Two FIs have seen increases in drive-up transactions of more than 100%. Other institutions with drive-ups saw a median increase of 50%. The more drive-up 24×7 ITMs that were installed at an institution, the higher the increase.

At the median, people felt that 20% of the increase in drive-up transactions would be permanent.

3. ATM transactions showed the biggest variance.

Half of respondents have seen increases of between 5% and 25%, and half have seen decreases between 12% and 60%. Estimates of how much the changes would be permanent ranged from 0% to 80%, but most people agreed that it will depend on stores’ willingness to accept cash when they re-open.

One interesting comment: “We saw a brief increase around the time stimulus checks started to arrive. That has tapered off.”

4. Contact center calls have gone through the roof.

Respondents reported very consistently that calls are up over a third, with the median at 36% and the highest at 80%. Almost every FI reported no change in contact center hours.

Several people said Paycheck Protection Program and loan forbearance queries contributed to the increase and made for longer call times.

The majority agreed that 20%-25% of this increase will remain post-COVID.

5. Desktop/mobile banking log-ins have increased, but not to the extent some of us might have predicted.

The median increase in log-ins was 18%, with low to high responses ranging from 5%-30%. Several people mentioned remote check deposit as a contributor to increased activity. This makes perfect sense given restricted branch access. Many FIs have increased deposit limits to help boost this activity.

One comment summarized what many FIs said: “While the usage of digital channels will likely continue to increase, it is higher than normal right now, as customers are waiting for stimulus deposits and watching their accounts closely.”

Most respondents agreed that at least half of this increased activity will continue.

6. Our new digital enrollment query produced mixed responses.

About a third of respondents said they’d seen no change in new enrollments. The rest saw an increase of between 5% and 20% with the median at 7%. It was widely reported that some of this increase was for practical reasons, e.g., a stimulus check had arrived.

The good news here is that everyone felt additional new enrollees would continue to bank digitally.

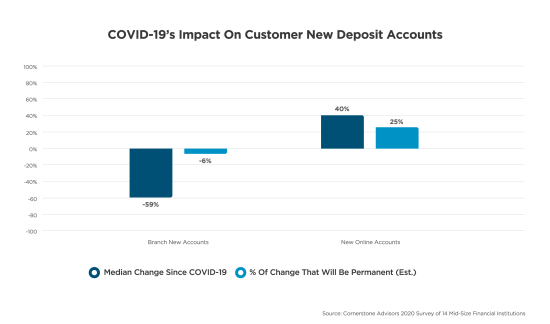

7. Lastly, we asked about new deposit account activity.

It is not surprising that, like servicing transactions, branch-based new account opening reduced heavily at every institution. The median number of accounts opened dropped 59%, with the lowest being 11% and the highest 90%.

Some of this drop was replaced by digital account opening. Median digital account openings increased 40%, with responses ranging widely from 5%-100%. This increase has to be put into perspective, however, since much fewer new accounts were opened in this channel to begin with. Pre-COVID, most FIs opened approximately 10% of their accounts via the online channel, with the other 90% still being opened in branches. So, the channel that produced 90% of the volume saw a decrease of 59% and the channel that was producing 10% of the volume saw an increase of 40%.

The real story here is that there are a lot fewer accounts being opened – anywhere. The digital channel hasn’t come close to making up what the branch channel was producing. We should note, however, that even with lower new account volumes, most of our clients are reporting very good net deposit growth (COVID-19 flight-to-safety for existing customers being the biggest reason).

Two interesting comments provided in the survey:

“After last year’s planning session, we really got going on driving online account opening. While many are low balance, they are also low-cost funds and exceptionally efficient to open.”

“The increase in online account opening is likely because the branch staff encouraged customers to open accounts online if they were unable to make an appointment in the lobby.”

Our take-aways:

- There has been some shift from branch and contact center activity to digital, but hardly at the levels we might have expected. It just doesn’t feel like COVID-19 was the event that suddenly made a branch customer go to mobile. At least not yet. Instead, two things have happened so far. One, there are just fewer new accounts and transactions being performed. The question here is whether those volumes will return, regardless of the channel used. Two, customers seemed to move to the next-most-logical channel (marketers, you are free to use our new terminology). Branch customers went to drive-up, then to the contact center. Some contact center clients went to digital. People who prefer digital to begin with used it more and ATMs were left alone to self-isolate.

- How much of the reduced customer activity will return post-COVID-19? If we look at the estimates of some very smart bankers here, it could be as much as 20%-30%. What does this do to channel planning? As bankers re-open, this might be the opportunity to accelerate efforts to create new go-forward delivery operating models.

- The mix of ATM numbers, combined with early retail re-openings, gives us the feeling that people may be using substantially less cash than before. We may have a medium-term need to look at the ATM fleet and, maybe, cashless branches again.

- If nothing else, COVID-19 provided the ROI for drive-up ITMs. That being said, an FI that weathered the storm without them would be hard pressed to make a business case for the incremental cost.

- There may be some stickiness in appointment banking, both at branches and for those who have video banking. After several years of try and fail, is COVID-19 the thing that finally gives appointment banking some legs?

- The opportunity cost of limited historical focus on digital account opening within community FIs is still unknown. The 40% increase on a small base is significant, but what if rather than fewer accounts being opened in general, the accounts that were being opened all gravitated to large players with great digital origination?

We continue to be blown away by the service ethic and customer focus of our clients. At the end of our survey, we asked for any general thoughts and would ask you to consider these:

“We are seeing our NPS go up significantly as we assist with loan payments, etc., and meet the daily banking needs of our members.”

“Loyalty and appreciation are being built with our business customers in the relationships that we have, due to our assistance with PPP loans in this time of crisis. As local banks continue to support the communities and businesses in their markets, customers will continue to support their local banks.”

We could not say it better. Hats off to all of you for the amazing job you are doing.

“USA Today has come out with a new survey – apparently, three out of every four people make up 75% of the population.” -David Letterman

Thank you to our survey participant institutions:

- American Airlines FCU, $7.7 billion, Dallas, Texas

- Bankers Trust, $5.0 billion, Des Moines, Iowa

- Citadel FCU, $3.8 billion, Exton, Pa.

- Coastal FCU, $3.4 billion, Raleigh, N.C.

- Consumers CU, $1.2 billion, Kalamazoo, Mich.

- First Commonwealth Bank, $8.3 billion, Indiana, Pa.

- Hudson Valley CU, $5.4 billion, Poughkeepsie, N.Y.

- First Merchants Bank, $12.4 billion, Muncie, Ind.

- Idaho Central CU, $5.0 billion, Chubbuck, Idaho

- Lake Michigan CU, $6.9 billion, Byron Center, Mich.

- The Bank of Tampa, $1.9 billion, Tampa, Fla.

- U.S. Eagle CU, $1.0 billion, Albuquerque, N.M.

- Two institutions completed the survey anonymously.