How to Look Fantastic While Getting Intimate with Your Vendor

Like most manly, bearded men, I never stop to ask for directions or a roadmap to navigate life’s twisted pageant. Nah, just gimme a spit-covered index finger to test the wind, a well placed sign or two and the sun and the moon and the stars, and I’ll get us anywhere worth going.

Yet, when it comes to keeping up with what’s going on with the bank tech vendor community, I need focus and direction – explicitness to help me track the vague moving target of chaos.

Yet, when it comes to keeping up with what’s going on with the bank tech vendor community, I need focus and direction – explicitness to help me track the vague moving target of chaos.

As you know, the Brown Ties at the FFIEC are pushing you hard on vendor management.

Just like every other prescription the FFIEC has written for whatever risk topic ails you, they want you to Understand, Monitor, Measure and Control your vendor risk. They want you to go deep with your key vendors’ roadmaps. With tough-as-nails earnings foes and the spectre of an angry CRE market threatening to kick our economic asses, bankers don’t need yet another distracting brawl with the Feds.

With tough-as-nails earnings foes and the spectre of an angry CRE market threatening to kick our economic asses, bankers don’t need yet another distracting brawl with the Feds.

So, you have to toe the line a bit. But for anyone with such worries, this IS NOT a risk management article!!

While you have to keep the Feds happy, that’s not why you should be all over your vendor’s roadmap. There are several other, much more important reasons:

- Money – The typical mid-size bank spends roughly 10% of its overhead on technology, making it the bank’s largest overhead expense item other than compensation and premises. With that kind of responsibility, CIOs have to know their key technology providers as soundly as commercial lenders know their key borrowers.

- Effectiveness – There is no way IT can support the technology needs in the lines of businesses (LOB) unless the CIO knows exactly what’s happening at the vendor and can provide an insightful take on what it means in practical terms to her LOB constituents.

- Credibility – You have to get yourself in position to pass the “Hey, Jim, quick question for you….” test your CEO gives you when you skulk past his office door. When at a conference your CEO sees that next cool, game changing geegaw the bank simply must have, you’ve got to be able to expertly get past the USA Today level of vendor discussion and rattle off some New York Times-worthy, perspective-ripe bullets in two minutes or less.

Here’s enough to get you started.

Big Picture

Big Picture

Develop a feel for the direction at your vendor’s corporate office. It’s time to push your vendor HARD for candid input on the major decisions being made in the ivory tower. That’s just step one. Step two is to develop your own spin on their plans and really think through how your bank could be affected by the decisions being made by a small and shrinking number of vendor execs.

Is your core product a likely survivor?

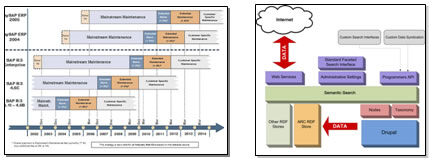

When you look at the array of core products your vendor offers, can you clearly see where your core product fits in or where it differs from other products in the vendor’s quiver? Core products with a shaky future obviously don’t garner the R&D dollars needed to keep your FI flush with fine functionality. No, they flounder in the dreaded (Nearly) Maintenance-Only Zone.

Here are a few practical examples from discussions I have had with clients.

- Where do the MISER and Horizon products fit in the new FIS organization? If I’m an $8B outsourced Horizon bank, is FIS going to try to push me to IBS (Metavante)? With both Horizon and IBS now in the FIS arsenal, is MISER going to be spun into a CU-only product?

The vendors may well have good answers to these questions. But more importantly, CIOs, you need to have your own clear, concise, thoughtful slant for your board, CEO and peers.

What is the corporate-wide ancillary product strategy?

Vendor consolidation of ancillary products is inevitable and smart. Why would a vendor fund six different Internet banking systems when it could perfect one badass IB system that fits well with all of its core products? It shouldn’t, of course.

But be prepared for the possibility that an ancillary system your bank adores – maybe one you have spent countless dollars and thousands of hours customizing and integrating – will go by the wayside. That announcement is not one you want to sneak up on you, CIOs; you want to be way out in front of it and ready to discuss it with your peers in the LOBs.

Some more real life conversations I’ve had that exemplify the vendor digging process you should go through:

- If my bank runs the Teres consumer LOS product in front of IBS, should I renew with Teres for three more years now or take advantage of the pricing I can get for FLO, the newest FIS consumer LOS for IBS? Does FLO’s reasonable pricing make up for its lack of proven installs in the IBS client base? Does my retail group care that FLO doesn’t support indirect lending?

- If I’m a Fiserv XP2 core client running Virtuoso Internet banking, how is Corillian’s inevitable emergence as Fiserv’s go-to IB product going to affect ongoing Virtuoso development? Should we go ahead and purchase/integrate the M-Com mobile banking solution now or wait until we get forced onto Corillian? Does Corillian even support M-Com?

Drilling Down

Now that you have some Big Picture issues figured out, it’s time to take a closer look at your core product.

What is the realistic outlook on my core vendor’s development efforts?

Sometimes, for a variety of reasons, we want so badly to believe the vendor’s development timeline that we eventually do, even when just a touch of cynicism, realism or well-targeted critical thought would have kept our zeal in check.

The vendor’s product roadmap PowerPoint slides with timelines and cool architecture charts will get you about 10% of the information you need. The rest has to be mined, finagled, and strong-armed from the vendor.

Some more real life conversations I’ve had with my clients, who wanted to know:

- As an OSI DNA customer, should I believe that OSI can swiftly build a solid replacement for its eCB Internet banking product? Will the migration be as “plug and play” as OSI told us our DNA migration would be, or will it be as problematic as the move to DNA was in reality?

- If I’m a CU utilizing Jack Henry’s Symitar product for core, should I believe the story about top quality mortgage servicing functionality under development? If I am considering the jump into the mortgage servicing arena, should I wait until Symitar gets the mortgage project done, or should I just implement FICS now?

Far too many CIOs pawn off deep vendor roadmap analysis and involvement onto their staff. For some vendor relationships, I simply don’t believe this is a luxury you have. As the CIO, you have to OWN at bare minimum your Big 3 vendor relationships in terms of dollars spent and strategic significance. Core, Internet banking and EFT are three usual suspects, often carrying hefty strategic significance and a monster portion of your systems spending.

So how does a busy CIO elevate to the lofty status of Lean Roadmap Ninja? Here are a few tips, the first two of which come from GonzoBanker’s own Quintin Sykes, former CIO of South Financial and fellow Top Notch Roadmap Spin Doctor:

- Take a leadership position in your Big 3 systems’ user groups. Leading the group helps you to:

- Drive and influence roadmap formulation;

- Establish deep contacts with your peers who are facing the same issues as you are; and

- See sneak previews of upcoming functionality before the general user base does.

- Demand at least semiannual, onsite meetings by your vendor to walk through roadmap items in detail with your IT management group.

A few other steps to consider:

A few other steps to consider:

- Immerse yourself in contract renegotiations, whether you do it yourself or with assistance. You learn a lot about a vendor’s corporate personality and how important your bank really is to them during a knockdown, drag out core contract renegotiation. Also, contract renegotiation time is the perfect time to contractualize key roadmap items.

- It’s almost too basic to mention, but you should track promised development dates versus actual delivery dates. The vendor’s record in hitting and missing these promised delivery dates should influence your take on future assurances. Your ability to spit out specific project successes/failures in detail will help your own credibility when communicating your opinions of the vendor’s planned development efforts.

Make a point to speak with clients who have recently purchased or decided to leave the vendor. New clients especially tend to have unique exposure to just how far the vendor is willing to bend to win new business. They should be just as flexible for you.

Make a point to speak with clients who have recently purchased or decided to leave the vendor. New clients especially tend to have unique exposure to just how far the vendor is willing to bend to win new business. They should be just as flexible for you.

So don’t bust out the Understand/Monitor/Measure/Control Dance because the Bank Pigs are making you. Get into some serious Participate/Criticize/Analyze/Spin to make yourself eternally credible and effective. In the words of the great Jim Rome: “Have a take. Don’t suck.”

Smart money’s on Spain by two goals this weekend.

–Hodgins ![]()

YOUR ONE-STOP RESOURCE FOR VENDOR EDUCATION

- “Should we stay with our existing core vendor or move on?”

- “How can we make the smartest decision for a new ancillary system vendor?”

- “What can we do to ensure we get the very best deal when we renew our vendor contract?”

- “Should we enlist professional assistance for our core conversion… or go it alone?”

If any of these questions sound familiar, it’s time to check in with the folks at Cornerstone Advisors. For more than a decade, Cornerstone experts have been assisting financial institutions with their technology assessments, vendor selections and core system conversions. We have helped our clients save big bucks in their contract negotiations.

Team up with the experts at Cornerstone for your next vendor decision.