10 Keys to a Succesful Online Banking Conversion

Faithful

Gonzo readers know that our position on system conversions is that they should be avoided unless absolutely necessary. That said, we maintain that there are times when having the

correct system

is a matter of necessity – survival, even. Nowhere is this truer than with online banking systems.

Faithful

Gonzo readers know that our position on system conversions is that they should be avoided unless absolutely necessary. That said, we maintain that there are times when having the

correct system

is a matter of necessity – survival, even. Nowhere is this truer than with online banking systems.

The virtual branch has not replaced the brick and mortar branch, the virtual branch has been added to brick and mortar as a primary delivery vehicle for banking products and services. In some demographics, the virtual branch is even more important than the brick and mortar.

The things that make online banking popular – easy access to information and services on a 24 x 7 basis through any number of channels – are the same attributes that make changing difficult. To paraphrase Esurance’s tagline, customers “want technology when they want it, people when they don’t.” Changing online banking is neither simple nor is it without consequences – but the decision to not change when change is needed is even more problematic.

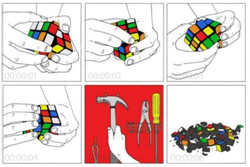

Do you remember the Rubik’s Cube craze of the 1980s? With the original 3x3x3 cube, there are billions of possible combinations; with the correct sequence of moves the puzzle can be solved in less than 26 moves. According to Wikipedia, in speed-solving competitions it has been solved in less than seven seconds. Several years ago, after spending several days off-and-on grappling with the Rubik’s toy, I was shattered when my school-age nephew solved it over and over, each time in less than a minute. Frustrated, I did a Google search and found that he wasn’t some budding mathematical genius; he had looked on the Web and discovered a process he could easily follow.

Do you remember the Rubik’s Cube craze of the 1980s? With the original 3x3x3 cube, there are billions of possible combinations; with the correct sequence of moves the puzzle can be solved in less than 26 moves. According to Wikipedia, in speed-solving competitions it has been solved in less than seven seconds. Several years ago, after spending several days off-and-on grappling with the Rubik’s toy, I was shattered when my school-age nephew solved it over and over, each time in less than a minute. Frustrated, I did a Google search and found that he wasn’t some budding mathematical genius; he had looked on the Web and discovered a process he could easily follow.

The real lesson I learned that day was that “knowledge is power.” Conversions offer a similar lesson – there are right ways and wrong ways to do them. After years and years managing dozens upon dozens of system conversions, we feel we would be remiss if we did not impart to our loyal readers, GonzoBanker’s 10 Keys to a Successful Online Banking Conversion. Here they be:

- The vendor should not be expected to handle all aspects of the project. Eighty percent (or more) of what is needed will fall to the bank to be done. While the 20 percent that the vendor does may be the fundation on which everything else is built, full investment by bank staff in the other 80 percent will help ensure the conversion’s success.

- An online banking conversion deserves the same commitment as a full-blown core conversion. In many respects an online banking conversion is more visible than a core conversion, and the same degree of structure and discipline will be required. The complexity of an online banking project, particularly the testing, documentation, business process resources, need for clear ownership of specific tasks and deliverables, and number of vendors that may need to participate rival a core conversion in scope and intensity. The need for planning, project management, risk assessment, risk mitigation, testing and contingency planning is paramount.

- Place a particular focus on those charged with managing customer communications (the marketing department with respect to managing the message, and call center and branch staff with respect to delivery of the message). Some banks try to minimize end-user awareness of the conversion by trying to “make it all look the same as before.” This only maximizes end-user confusion and frustration because the new system will be different – different log-ins, changed password requirements, special multi-factor authentication procedures, changes to browser setting, etc. It is imperative to communicate frequently over all channels (statement stuffers, point-of-sale posters and placards, email, the bank’s public Web site, secure messages, etc.) and assume that no more than one-third of customers will read what they are sent in the mail. A splash screen or banner page put up on the old system well before conversion materially increases the chance of messages being seen and understood. If only 30% read emails or look at a banner page, that is still 30% less than will call or visit a branch at conversion.

- Test, test, and then test some more. We have seen too many examples where banks have not tested effectively and then find “defects” – which may really just be differences from the current system. Watch out for features and functions in the old system that are not widely used but that are being used – 500 accounts out of 20,000 using a feature not supported in the new system can still be a big problem if they are discovered after go-live.

- Only a minimal number of new features should be introduced on go-live date. A lot of change all at once can be overwhelming to customers and call center staff. Even simple look-and-feel changes will throw some customers for a loop, and some new features will be viewed as “defects” until customers become familiar with them. This is particularly true of increased security features (e.g., improved multi-factor authentication), which are necessary to protect the bank but the benefits of which may not be apparent to end-users. Customers will appreciate the opportunity to get used to the new system slowly. To help ease the pain of transition, the bank can roll out new features gradually over time.

- Training and internal preparation are critical. All customer-facing staff must be trained, not just those managing the online banking channel. Although people who use online banking will contact the call center from their cell phones long before they drive to a branch, branch personnel must be prepared for person-to-person support if and when it is needed.

- Prepare for a marked increase in call center activity, both voice and email. Many online banking customers do not log in during normal business hours, so extra staffing and extended hours on go-live day are a good idea.

- Change bill pay providers cautiously. In our experience, the major bill pay providers are mature and sophisticated vendors; they know what to do. Still, banks changing providers should ensure the vendor has adequate support resources.

- The “conventional wisdom” of conversion timing warrants a second look. With core conversions (and many other major conversions) it has become de rigueur to convert over a weekend – after Friday night’s processing or even in the middle of the night on a Saturday night/Sunday morning. With online banking, traffic patterns are different. People do use those channels at odd hours, and converting when the call center is open (or opening the call center on a 24-hour basis for conversion weekend and a short period thereafter) may make sense.

- Consider handling commercial cash management customers individually. These customers tend to be complex and high-maintenance, and hand-holding them individually through an online banking system change is a wonderful opportunity to build a relationship and ensure that conversion-day issues are handled correctly.

Which comes first, the chicken or the egg? Do we gain online banking customers and then install a robust system, or do we install a robust online banking system in expectation that the customers will come? In the last year we have seen more interest in upgrading online banking systems than ever before, and the inadequacy of some online banking systems will continue to force a wholesale re-evaluation of the pros and cons of making a change.

Which comes first, the chicken or the egg? Do we gain online banking customers and then install a robust system, or do we install a robust online banking system in expectation that the customers will come? In the last year we have seen more interest in upgrading online banking systems than ever before, and the inadequacy of some online banking systems will continue to force a wholesale re-evaluation of the pros and cons of making a change.

Changing an online banking system is a difficult decision, but if a change is to be made, these best practices will go a long way toward making the transition successful.

-bm

Are you a victim of System Selection Roadblock?

Financial institutions can spend huge bucks on a new system – whether core, online banking, or other ancillary system. Unfortunately, many find themselves victims of the three major roadblocks that stand between their organization and a successful system selection:

- A shortage of information about vendors and their products;

- Lack of a clear methodology; and

- Minimal time to manage such an important project.

Enter Cornerstone Advisors. Backed by well over 200 vendor selection, system conversion and contract negotiation engagements, Cornerstone has the in-depth knowledge and tools to help financial institutions make informed, well-documented vendor decisions that support the organization’s strategic goals.

Visit our Web site or contact us today to learn how we can ensure your next vendor experience is a good one. Remember to ask for our references!