Vendor Management

Reduce expenses. Improve vendor performance. Manage risk.

Ready to Think Differently About What to Expect From Your Vendors?

Many financial institutions are hemorrhaging money and missed opportunities due to incomplete and inefficient approaches to vendor management. Additionally, vendors play a mission-critical role in your customer or member experience, so these relationships must be actively managed. Today, your vendor’s performance is your performance.

Gain a Competitive Advantage

With years of experience selecting, negotiating, contracting with, and managing vendors, we will help you go beyond thinking of vendor management as a compliance exercise and lead you toward actively managing vendor performance to gain a competitive advantage.

That’s why we offer Vendor Performance Management (VPM). This unique combination of services and technology will:

• Save you millions of dollars

• Improve vendor performance

• Manage risk

• Increase efficiency

• Ensure you pass your exam with flying colors

Experience & Results You Can Trust

$7B+

Total negotiated contract deal value (since 2019)

$17.93M

In savings achieved for financial institution with $4.5B in assets

$15.67M

In savings achieved for financial institution with $929M in assets

$4.23M

In savings achieved for financial institution with $1.57B in assets

Services

Vendor Performance Management:

Services + Software

Cornerstone’s Vendor Performance Management (VPM) offering is a turnkey vendor management program that consists of a full range of “white glove” vendor management services delivered by our contract management and negotiation professionals. We deliver these services through our vendor management software platform, Vendor Vault™.

Contract Management

Consistent with regulatory guidelines and best practices, we work with you to upload your contracts to your contract database in our software platform and provide email alerts to make sure you don’t have contracts rolling over.

Vendor Planning

We apply years of expertise and knowledge to evaluate your vendor relationships. We help create a plan for how and when to engage vendors to get the best pricing possible, fair contract terms, and vendor performance measurement.

Vendor Risk Assessment

We perform a risk assessment of each vendor and risk rank all your vendors into three categories: critical, important, and exempt.

Exam Preparation and Assistance

We built exam planning into our platform, working with you to make sure you’re ready for the exam. We can even participate with you and your examiner upon request.

Vendor Due Diligence

We gather vendor due diligence and select important vendors each year and upload the information to our software for your review, saving you tremendous time and staff resources.

Due Diligence Summaries

Our vendor review kits, which summarize a vendor’s due diligence package, condenses hundreds of pages into a simple checklist, saving hours of effort and making it easier to review.

Performance Measurement

We negotiate relationship contracts with your key vendors that include an agreed scorecard to measure vendor performance, and a meaningful process to work with the vendor after the contract is signed. Our services continue through the entire initial term of the contract to make sure you get what you paid for.

Vendor Vault™

When you engage Cornerstone for vendor management services, you will also get exclusive access to Vendor Vault™, our powerful, yet easy-to-use technology platform. It will enable you to manage the entire vendor lifecycle from onboarding new vendors to ongoing management and continuous monitoring. It is the vehicle we use to deliver the full array of vendor management service to your institution.

Maximize Your Negotiation Power with Our Contract Negotiation Services

Cornerstone’s negotiation expertise is well known in the industry. Negotiation services are part of our Vendor Performance Management offering. We will review your key contracts to identify opportunities for expense reduction. We’ll uncover multiple ways to reduce your vendor expenses, help you select the right vendor, and get the best prices and fair contract terms. We will level the playing field for you, providing objective analysis on current market pricing and deliver contracts that position you for success now and into the future.

Platforms & Tools

Powered by Data

By combining our experienced negotiators, our proprietary data and our vendor management platform, we are able to level the playing field for you, providing objective analysis on current market pricing, and delivering contracts that position you for success now, and into the future.

Contract Vault™ is our proprietary data engine of over 15,000 pricing points collected from negotiating thousands of vendor contracts. Leveraging this information, our team of negotiators provides financial services executives with an objective analysis of market pricing and how it shifts with size, volume and contract length.

Vendor Vault™ is our powerful, yet easy to use vendor management platform for ongoing vendor monitoring. It was specifically designed to help you stay on track and ensure you pass your exams. Vendor Vault™, provides data on hundreds of industry vendors serving the financial service market.

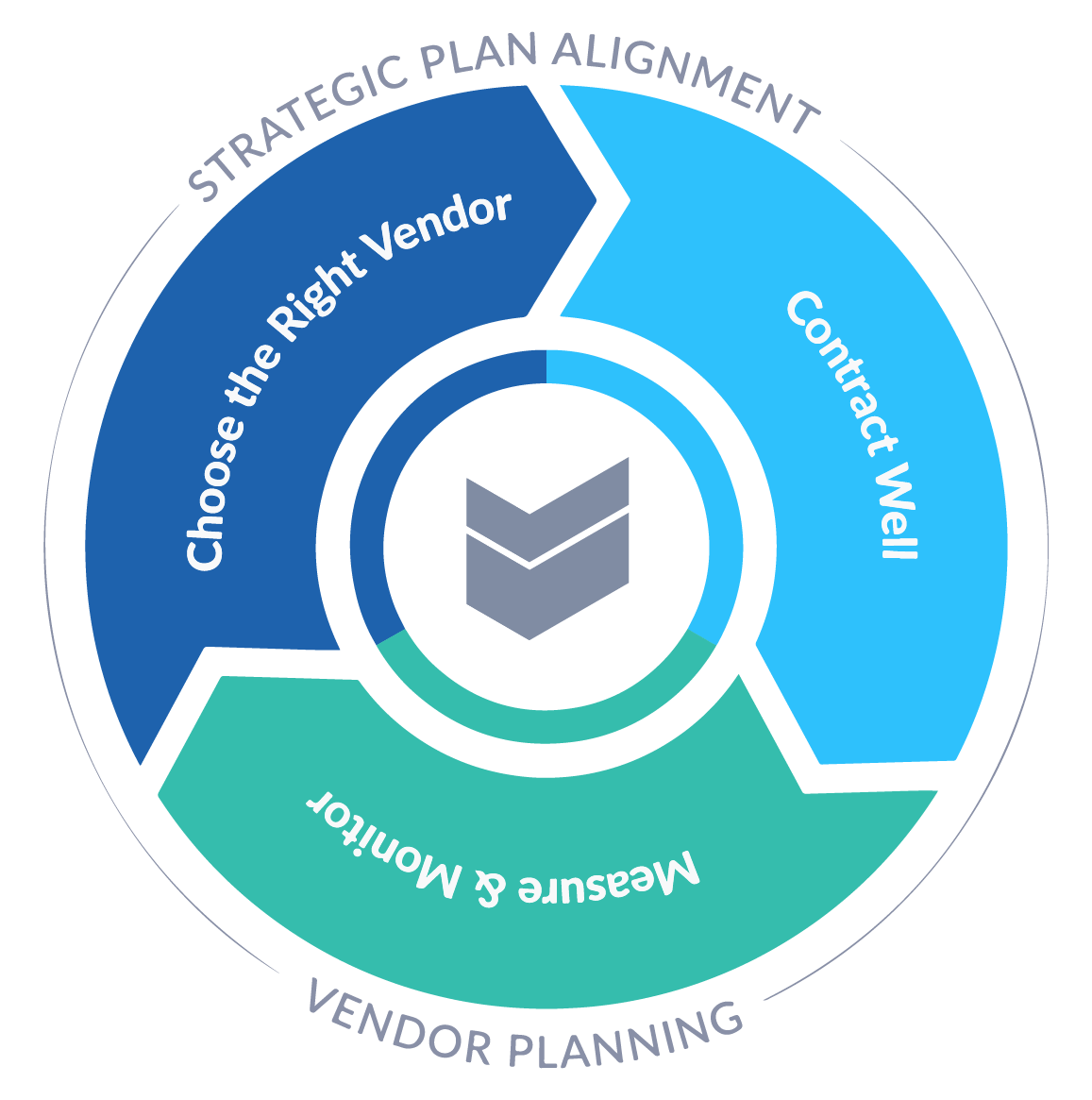

Manage Your Vendor Relationships With a 360° Approach

With the right vendor management strategy, you can manage all your vendor relationships—starting from partner selection and contracting to ongoing measurement, monitoring and risk mitigation. VPM provides clients with a 360° vendor relationship management solution so you can:

Choose the Right Vendor

Our process helps you select vendors that deliver the results you want and moves beyond a singular focus on features and functions.

Contract Well

With Vendor Performance Management, performance and price are defined in a way that ensures you get a fair contract, with the right results, at the right price.

Measure and Monitor

Our system effectively and consistently measures results and monitors vendors’ performance to verify that you get the results you want and pass your exam.

Strategic Plan Aligment

Evaluating your vendor choices and vendor performance with your strategic goals positively affects your ability to execute your strategic and operational plans.

Vendor Planning

Planning what price you want to pay and what performance you want from your vendors, and planning how to align contracts and use time and competitive pressure to maximize your negotiation power, is the smart way to drive vendor performance.

Meet Your Vendor Management Experts

.png?width=172&name=Josh%20Layne%20-%20Headshot%20-%20Circle-1%20(1).png)

Josh Layne

VP of Client Success & Compliance

Josh Layne brings vendor management best practices and program development experience to Cornerstone Advisors. With nearly 20 years in the banking and credit union industry, he has worked with clients directly and through his team of success specialists to implement and create efficient and effective programs, right sized for each client's needs and focused on results.

.png?width=172&name=Kelli%20Schultz%20-%20Headshot%20-%20Circle%20(1).png)

Kelli Schultz

Principal

Kelli Schultz is a seasoned strategic business executive with a proven track record of driving expansion and operational excellence within the payments and broader FinTech and RegTech sectors. With over 25 years of experience in building successful products, teams, and companies, Kelli excels in leading operational transformations and revamping business models to maximize revenue and capture cost reductions.

.png?width=172&name=Brad%20Mason%20-%20Headshot%20-%20Circle%20(1).png)

Brad Mason

Senior Director

Brad Mason expertly negotiates the complex strategic relationships between financial institutions and financial technology providers. Over the course of his career, Brad has led strategic business development at numerous major financial technology suppliers, an experience that has equipped him with keen insight into relationship negotiation, market and opportunity analysis, and coordinating cross-organizational teams for success.