‘MapQuest Mode’ Is Blocking the Rewards of Commercial Loan Origination Systems

The good news: 5 key steps can get banks and credit unions on the road to recovery.

In my younger days (think post-cave drawing but pre-smartphone), my friends and I used MapQuest for navigation. Does anyone remember MapQuest? Once we fed our destination into the website on our PC, we had to print the turn-by-turn directions plus the map on paper! Compared to today’s Google Maps smartphone app, the MapQuest Mode was seriously clunky. But at the time it was the bomb, and we dug the way it got us where we needed to go.

Today I’m the bearer of bad news for commercial lenders. Many financial institutions are still using legacy credit memo functionality in their loan origination systems, an old-school paper-based practice that I will liken to the MapQuest Mode for navigation. Now, the credit memo goes by many different names, including credit approval request form, credit approval form and loan approval request form. But however it’s labeled, a backward reliance on this functionality is greatly impeding the potential of today’s end-to-end commercial LOS platforms. And it’s costing banks a lot of money.

So fast forward to today’s end-to-end commercial LOS platforms. I’ll call this navigation functionality “Google Maps Mode.” These systems enable financial institutions to better capture loan details and supporting documentation/data provided by borrowers and/or third parties. While it may be in a slightly different (and uncomfortable/unfamiliar) format, the data elements are readily available in real-time. Source/supporting documents are available in the LOS and organized by client, collateral or loan record, making access more readily available. There’s no need for a credit analyst to provide a lender with the paper-based “most recent version” — everything is available in real-time, speeding the overall process and moving banks forward in their commercial lending digital transformation.

But when MapQuest Mode is forced back into the process, digital transformation comes to a screeching halt. The financial institution forces the system to execute an extreme, parallel, “point-in-time” version of various elements using the MapQuest Mode while trying to keep up with the real-time version using the Google Maps Mode.

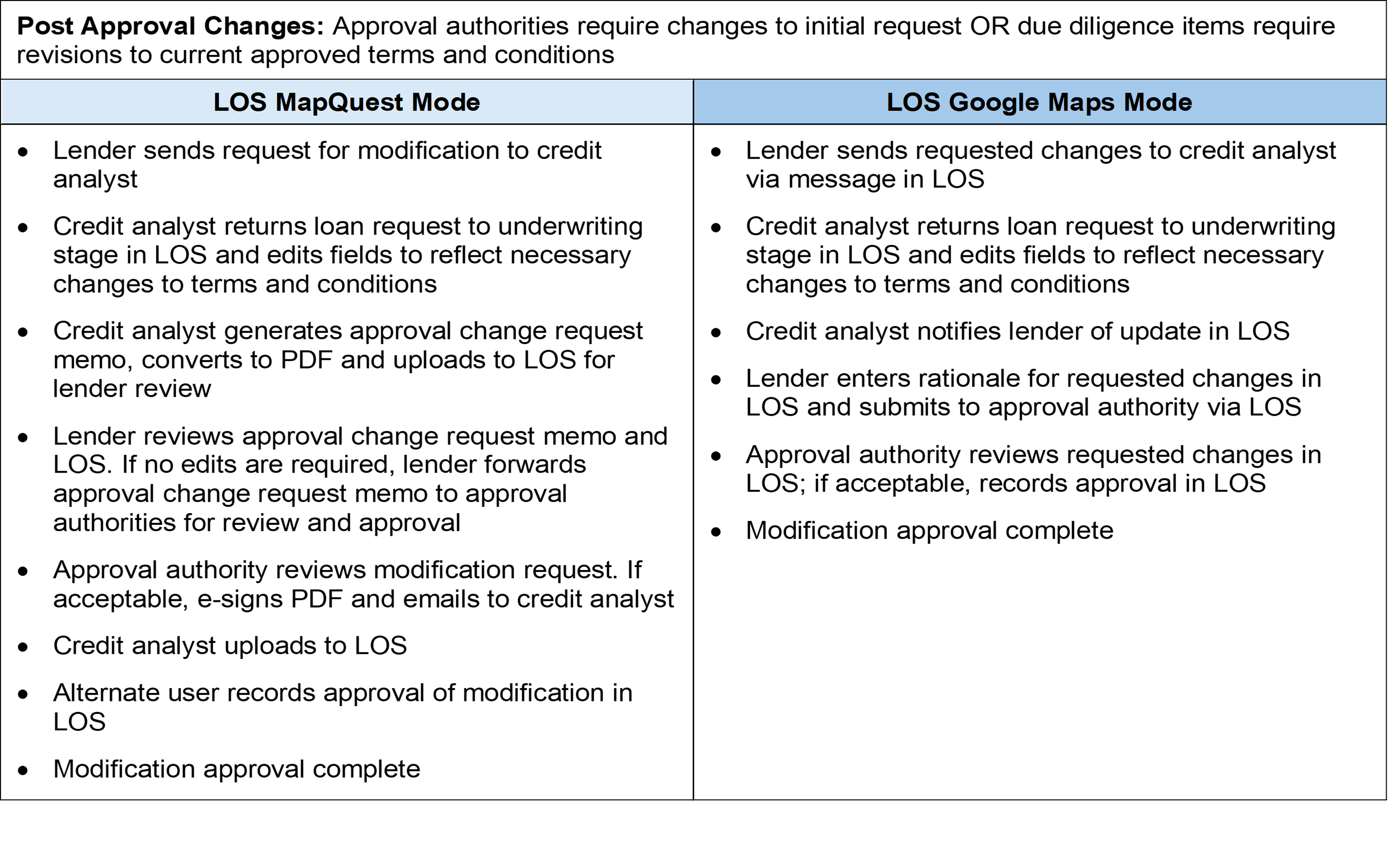

Here’s a comparison of post-approval commercial lending activities using MapQuest Mode and Google Maps Mode:

Reviewing the above comparison, we are hard-pressed to justify retaining LOS MapQuest Mode. The familiarity of the old credit memo is comforting, and transformation is uncomfortable. Still, the benefits are well worth it for everyone involved at the financial institution and, more importantly, the customer/member.

Financial institutions caught in MapQuest Mode with their commercial LOS should begin their trip down the road to recovery with these five steps:

- Evaluate your current credit memo content against information that will be captured in the commercial LOS.

- Identify any gaps in the commercial LOS and determine if the content is needed in the LOS environment or if it’s just a “we’ve always included this but don’t know why” scenario.

- Configure the LOS to include the appropriate data capture method for the content still needed (drop-down field, free text, etc.).

- Set the stage for the credit request review to be completed entirely in the LOS and provide training that explains how credit memo content is being captured/displayed.

- Shift the use of the credit memo from the set of directions to get from opportunity to closing to a recap of the actions taken (along with their justification) after the action has been taken.

The forced use of the credit memo in the origination process is one of the greatest obstacles to the benefits available in a commercial loan origination system. Only when financial institutions break out of MapQuest Mode can they move forward on their commercial lending digital transformation journey.

Joel Pruis is a senior director at Cornerstone Advisors. Follow Joel on LinkedIn.