The Next Killer Digital Banking Feature Doesn’t Come from Being ‘Boring’

Bankers are not meant to be renegades, but now is not the time to shy away from deploying new ideas.

Right now, one of the trendiest words in banking is living up to the industry’s stereotype — “boring.” Cue the Patagonia sweater vests and soft jazz music.

According to a Businessweek article, the word boring has been used by bank execs and analysts at least a dozen times on banks’ conference calls as of May this year. Here’s where it gets interesting: That amount is twice the 2022 mentions, before the Silicon Valley Bank run.

It makes sense. It’s not as if bankers are putting on their version of Cirque de Soleil in their branches (as far as I know). They work to keep money safe at established brands that they don’t want to sully. In other words: boring means safe.

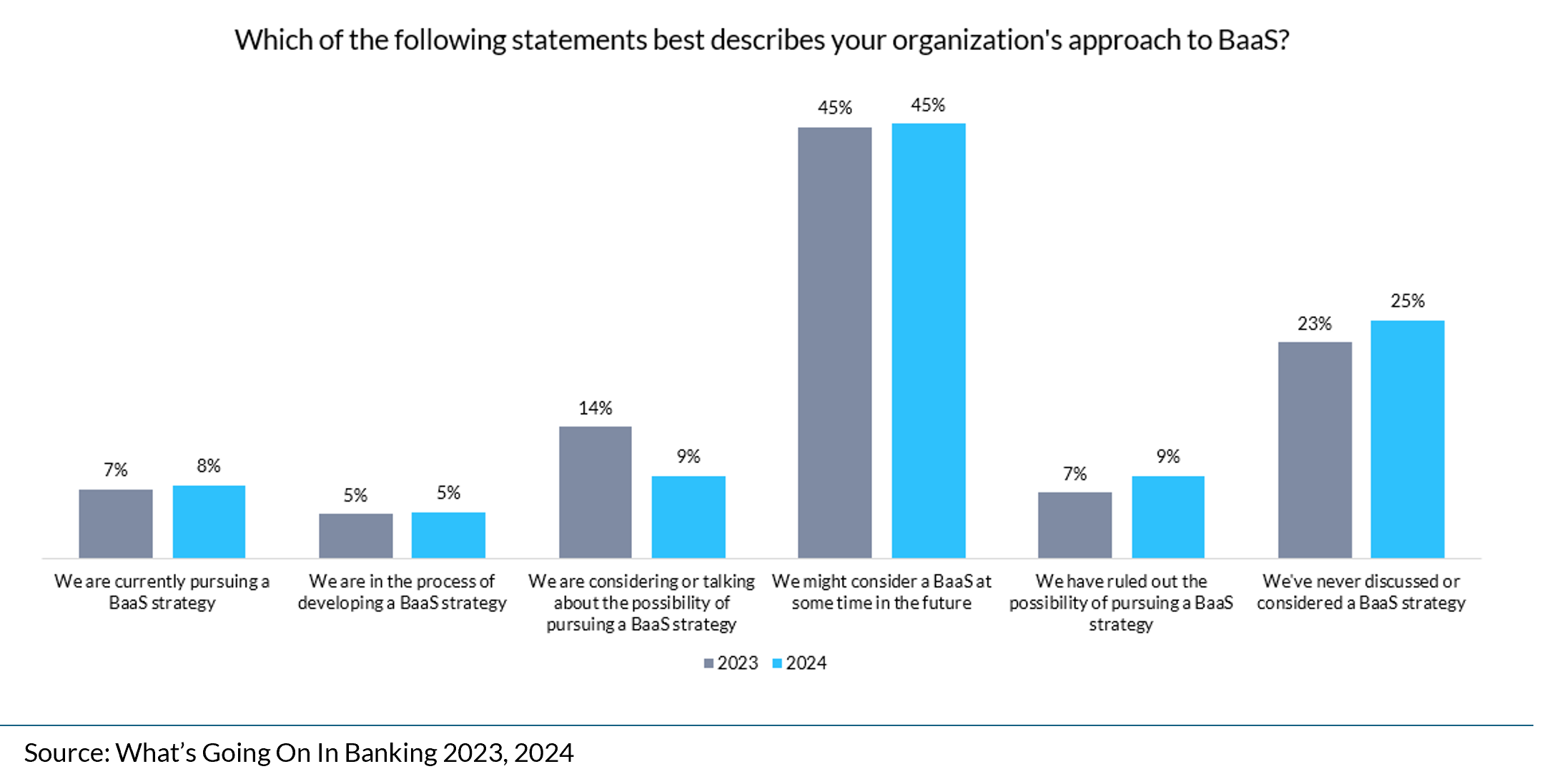

With the latest scandal entangling fintech middleman Synapse and its partner banks, it wouldn’t be surprising for more bankers to embrace “boring” over “daring,” with executives fearing what could go wrong with banking-as-a-service partnerships or, more broadly, with their fintech pairings. Data from Cornerstone Advisors’ annual What’s Going On In Banking report showed that fewer financial institutions are considering pursuing a BaaS strategy — and that was ahead of the Synapse drama.

Yet, the bank innovation labs of yesteryear replete with segways didn’t go undetected. I was in them — literally. There’s another side to banking, a side that wants to try new things to remain relevant in the coming years and decades. That’s a good thing. Keeping the status quo isn’t an alluring business proposition, especially with old revenue models like overdraft fees getting slashed by regulatory forces. Nor is it a winning strategy.

According to Cornerstone’s Digital Banking Performance Metrics study, the percentage of new accounts opened in digital channels dropped for the second straight year. That’s not what’s happening with digital banks and fintech firms. Chime says it has 7 million active checking accounts, for instance. Revolut says it has more than 9 million customers in the United Kingdom and 40 million globally.

It’s one thing to open accounts and another to offer some new value. Even fintech founders say so. Ethan Bloch, the founder of Digit (now Opportun), said of the automated money app on the first episode of Money isn’t Everything that the Digit team did a lot of great work but didn’t get “anywhere close to my aspiration and dream.”

“And it wasn’t just us,” Bloch said. “We started Digit in 2013. A lot of other fintechs were started or gaining traction around then: New Age fintechs, Robinhood, Cash App, Chime, Credit Karma. Fastforward 10 years, and I’m disappointed in what we all achieved.

“There have been some great innovations. There have been things that have helped people. But it’s been somewhat underwhelming for me. Even though some big businesses have been built, it’s not been the shift forward I would have liked to see.”

If ever there was a call to arms to help develop products to improve financial outcomes, it’s these comments. There are all kinds of things to overhaul, or at least improve, including on the digital product front. And the job isn’t limited to fintech companies. Banks can have a go at it, too. In recent weeks, the Office of the Comptroller of the Currency, which oversees 816 national banks, has been advocating for financial health pursuits.

Some promising news: There are glimmers of innovation perking up on the digital bank product front that could be worth pursuing. Consider these less-explored ideas for digital banking products:

- Subscription services. Many consumers have a wide range of recurring bill payments — Netflix, auto payment, the New York Times, yoga studios — and lack awareness of how much they spend on them. Banks and credit unions may want to consider layering functionality into their digital banking apps that lets people see their subscriptions and cancel them should they wish. Unlike traditional personal financial management tools, it offers an obvious way to save some money.

Earlier this year, Mastercard and Visa started offering banks the ability to let customers cancel, pause and resume their subscriptions, among other things. Most recently, Atomic launched a product that lets consumers do that from their bank apps. Frost Bank has committed to deploying the tech. - Self-driving money. This is a tall order and one plenty of entrepreneurs have tried and failed at. But it’s still on the minds of founders as something that would benefit consumers and small businesses alike; namely, outsourcing most financial decisions to a money app. As Bloch of Digit said: “It would look like you could wake up in the morning and not really have to think about paying your bills on time, not have to think about how much you’re going to be setting aside today. You would just be less stressed financially.”

- Well-being perks in banking. Increasingly, research and trade shows are giving airtime to how deeply connected mental health and finances are. We’re starting to see traces of that connection cameo in financial services apps. Some digital banks in the U.K., like Monzo, let customers block their attempts to gamble, for example. Wells Fargo launched a credit card that rewards people for spending on self-care things, like pets, spas and fitness. And Charlie, a neobank for the over 62 crowd, is working to help reduce financial exploitation of older adults.

Bankers are not meant to be renegades, and more regulation tied to fintech is likely coming. And yet, now is not the time to retreat from deploying new ideas — especially within digital banking products. What’s at stake? Customers.

While it’s not easy to move first on deploying a newer feature, especially at a bank, there is one suggestion from an entrepreneur and former banker worth remembering: “Just try to come up with something that you can prove there’s some revenue to,” Jim Bruene, the founder of Finovate, said in a recent podcast episode.

As Bruene sees it, there is a way for bankers to charge for services in exchange for added value.

“You can’t really charge anybody to look at their data,” he said. “But I think you can and could and will be able to bundle premium services and better customer service, better security, and this and that feature.”

Mary Wisniewski is an editor-at-large at Cornerstone Advisors. Tune in to her Money Isn’t Everything podcast and follow her on LinkedIn.