Carmageddon: The Downshifting of America’s Auto Industry

The American auto industry is on the verge of a bubble that is ready to pop.

I won’t go so far as to say we are headed to a period of total stagnation where nothing moves and prices drop 50%, but rather we are moving toward an adjustment period where we will experience a new normal. As the players that have financed the recent boom in vehicle sales start to feel the burn of this downward shift, the C-suite will need to start strategizing for this adjustment.

The following data illustrates the current situation.

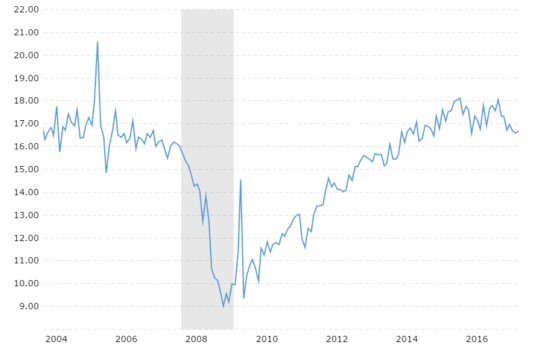

FACT #1: U.S. auto sales are starting to plateau.

Source: Macrotrends

The United States has been running at record post-recession highs over the past couple of years in terms of sales volume, prices, and availability of credit. After initial projections from J.D. Power that called for increases in sales to 17.6 million units for 2017, Moody’s and Edmunds are now forecasting declines to 17.4 and 17.2 million units, respectively. These sales numbers are still extremely high but this begs the question: Is the level of production sustainable? Bankers should be skeptical about whether manufacturers can continue pushing out units at record levels. Major auto producers have been missing sales projections left and right for most of the year thus far.

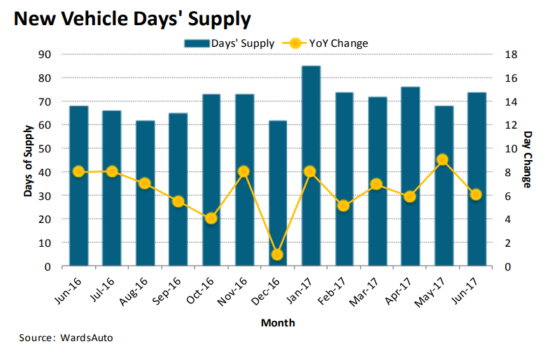

FACT #2: Auto inventories and incentive spending are at all-time highs.

Inventory days climbed from an average of 66 in June 2016 to 74 in June 2017. Since vehicles are sitting on the lots longer, dealers have been forced to increase their incentive spending for the 27th month in row. According to Autodata, average spending reached $3,616 per unit, an 11.7% increase year over year.

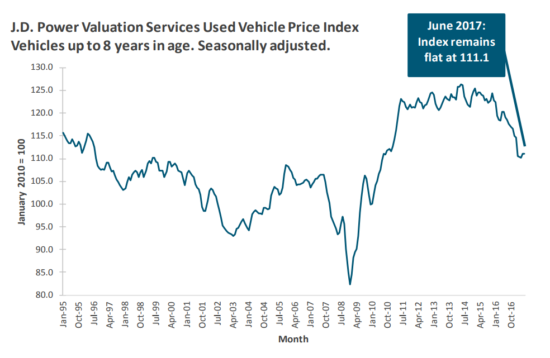

FACT #3: Used vehicle prices are dropping at an accelerated rate.

The inventory glut has created an environment where new vehicles are almost as cheap as late-model used vehicles. This is putting downward pressure on used car prices and ultimately hurting bank and credit union portfolios.

The used-vehicle price index from J.D. Power Valuation Services remained flat in June compared to May of this year. However, the index is 7.6% lower than where it was in June 2016. These declines can be attributed to the increase in ridesharing and off-lease returns, among other factors.

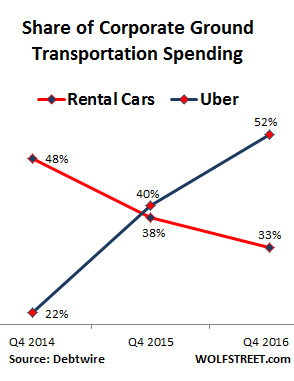

With the rise in popularity of companies like Uber and Lyft, fewer people are utilizing rental cars when travelling. Corporate data released by Debtwire shows corporate spending was divvied up between Uber and rental cars for the past three years.

Missing from this list are taxis, whose share dwindled to 12% in Q4 2016. According to an estimate by Boston Consulting Group, “One-quarter of miles driven in the U.S. may be through shared, self-driving vehicles by 2030.” This is a massive cultural shift and in response to dwindling market share, rental agencies will have to “right-size” their fleets by selling off large quantities of excess inventory, saturating the used vehicle market in the process and driving down prices.

Off-lease returns to the dealership are also at all-time highs. Returns are expected to reach 3.36 million this year, further stoking the flames of abundant supply. This is a 9% jump year over year on top of the whopping 33% jump in 2016. The lease return volume will continue to grow in 2018 with returns expected to hit 4 million. With all that inventory sitting around, dealers will have no choice but to slash prices to move these vehicles off their lots.

The Real Problem

The fan stoking the fire here is cheap credit. Over the last five years, banks and credit unions have been loosening underwriting policies to maintain competition in the growing auto market. According to Edmunds, in the first nine months of 2016, 32% of all U.S. vehicle trade-ins carried outstanding loans greater than the value of the car. This is a record high. Not only are consumers buying vehicles en masse thanks to cheap credit, institutions are allowing them to roll thousands of dollars in negative equity into the new loans. Some lenders have been allowing their borrowers to finance up to 130% loan-to-value. The credit risk here is astounding. Lenders mitigated a portion of this by selling the risky paper to investors. But what happens when the defaults start to rise, yields tank, and no one wants a seat at the table?

The fallout from this easy lending has started inspiring lenders to pull back the reigns. According to The Wall Street Journal, major lenders Wells Fargo and Santander Consumer USA are reporting declining auto originations, especially in the sub-prime market – 29% and 21%, respectively, from the year-ago quarter. Chase and Ally are also reporting drops in originations.

The industry is also seeing portfolio conditions progressively weaken. Institutions are posting higher losses on defaulted loans thanks to borowers falling behind on payments as well as the declining value of used cars. Subprime loan losses, annualized, were 9.1% in January 2017, up from 8.7% in December and 7.9% in January 2016. Recovery rates on sub-prime loans fell to 34.8% in January – the worst since 2010. Lenders aren’t seeing this only in the subprime market. The recovery rates on unpaid balances from prime loan reposessions have dropped from 65% in 2011, to 56% in 2014, to 51% curently.

Profitability assumptions made by senior lenders regarding both the return and embedded risk of auto lending may be materially flawed. It’s time for bankers to conduct a strategic review of their auto lending business by asking themselves three questions:

- What returns and potential deterioration of credit quality are possible in the next few years as the auto bubble begins to burst?

- As the landscape and dynamics of the auto industry change, where do we want to play strategically in the long term?

- How can we adjust our underwriting policies to ensure our customers are set up for financial stability?

Here are a few ideas to get started:

- Heighten the visibility of portfolio concentration in conjunction with loan regression analysis.

- Do a deep dive with risk-adjusted returns on new money and determine what pricing and level of production is sustainable in a down-market.

- Leverage analytics and digital marketing to capture the right kind of auto lending within the current retail deposit base.

- Implement a strategic risk monitoring process for eventual shifts in the auto industry.

- Have the notebook ready when examiners arrive – documentation may be your saving grace.

It’s possible industry executives could take these facts siloed and dismiss them as cyclical softening. However, when painted out together it’s easy to see that a deeper look is needed. These troubling trends should not be ignored.

-mr