Small Business in Eighth Place?

Bank executives may talk about the pressing need for low-cost deposits, but they seem to be ignoring one of the most bountiful sources of these funds: the small business owner.

In a recent survey conducted by Cornerstone Advisors, bank CEOs were asked about their top concerns, priorities and initiatives for 2017 and beyond. As it relates to growth strategies, the bank CEOs indicated their top two priorities were:

- Commercial loans (top priority for past three years)

- Commercial cash management/fee income (sixth in 2015, second for 2016 and 2017)

And six places later …

- Small business market share (fourth in 2015, third in 2016, and now eighth in 2017)

As a former commercial lender, I love the focus and attention on commercial lending, but I also see the small business market as an exciting and dynamic segment. Given that commercial lending has been a top priority for these bank CEOs for the past three years, banks have knocked out some pretty impressive growth.

From 2014 to 2016, the commercial loan growth has been almost 20% in commercial and industrial (C&I) lending and just under 22% in commercial real estate (CRE). But let’s take a little deeper look at the numbers and, more specifically, the resulting portfolio distribution as of 2016.

| 2016Y | <= $10B | > $10B | Difference |

| Total CRE Loans ($000) | 576,452,348 | 709,863,798 | 133,411,450 |

| Total C&I Loans ($000) | 284,575,877 | 1,431,987,371 | 1,147,411,494 |

Notice the gap in the portfolio balances, specifically the difference in funding for CRE versus C&I loans. Looking at market share, banks with assets of $10 billion or less have 45% market share for CRE portfolios but a meager 17% for C&I loan portfolios. Small business falls into the C&I loan portfolios. So, is 17% enough of a market share?

While banks under $10 billion may struggle to compete for the very large balances, the small business market is wide open and available to these institutions. Whether a bank has $25 million in assets or $1 trillion in assets, both can make a $75,000 small business line of credit or term loan. More importantly, the small business segment is ripe to support the second growth priority – commercial cash management/fee income.

Even with the real estate issues in the early ’90s and the Great Recession, the growth in the portfolio and resulting customer base for banks under $10 billion has once again been with the CRE segment. CRE will generate some loan origination fee income, but commercial cash management fee income is rather elusive. In fact, CRE has historically been a large user of deposits as the actual deposits associated with these relationships are a small fraction of the commercial loans outstanding. Commercial cash management services and resulting fee income only come when a bank gets serious about the C&I and small business segments.

Bankers may need reminding of some critical metrics that still apply to the small business segment:

- One half to two-thirds of small businesses in a region don’t borrow. They may have credit, but they don’t use it.

- As a result, small business portfolios are a net deposit generator to the tune of $2 of deposits for every $1 of loans.

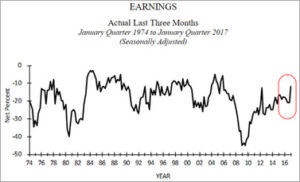

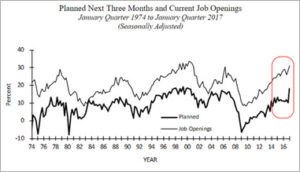

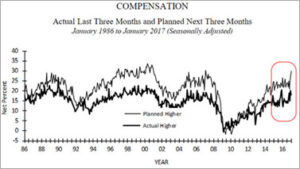

Let’s combine these facts with the recent reports of small business optimism from the National Federation of Independent Business, specifically:

Earnings improvement

Hiring Trends

Actual/planned payrolls

Producing optimism around future expansion

Given the dominant market share of the larger financial institutions and all signs pointing to an increase in demand and overall performance, the small business segment is a fantastic opportunity for $10 billion and smaller financial institutions. Those financial institutions that make a substantial shift in strategy and reprioritize the small business segment will still meet their critical needs (low cost deposits, treasury management fee income, and greater efficiencies).

These strategies include:

- Talent – Recruiting and developing a crew of small business bankers who infiltrate local markets still works, and there are viable candidates who are tired of small business being ignored at bigger banks.

- Mobile first – No bank can seriously go after the small business segment in 2017 without offering a slick, user-friendly mobile banking experience that is consistent in capabilities with traditional online cash management products. Business owners use mobile for every other aspect of their operation, and they expect it in banking.

- Self-service experience – More self-service capabilities for things such as advances and paydowns on lines of credit are needed conveniences for small businesses, and they also help address the efficiency of managing a large portfolio of small notes.

- Online credit application capabilities – Small business owners will appreciate not having to shut down operations just to apply for a loan during branch hours.

- Specialized call center agents – Reps with deep small business expertise sends a message to your customers that they’re dealing with individuals who fully understand their needs.

- Industry niches – Developing specialized expertise and working inside centers of influence for specific industries helps make the business development and credit underwriting processes more effective.

Funding is everyone’s priority today, but it appears the small business segment is not getting the attention it deserves from bank executives. Delay and play catch up later for the scraps, or focus now and start reaping the benefits.

-JP