My Place or Yours? (Or a story from the hell of trying to buy a house in Phoenix)

As most of you know, the Cornerstone Mother Ship resides in the Land of the Sun in glorious Scottsdale, Ariz. And for those of you in colder climates, we are always ready to greet you here at our offices if you need a break from the snow. Up until this spring, I had actually worked remotely from my Kansas “office.” It wasn’t unusual for me to watch house prices decline in the greater Phoenix area at the same inverse rate as snow increased outside my windows on the prairies in Kansas. After much internal conflict, I finally decided that I had to look for a house closer to work and higher temps.

This story is about one man’s journey to buy a house in the post “financial meltdown” from the consumer’s viewpoint and to see if greater conclusions can be drawn.

I started looking for a house in Phoenix in February of this year. I chose a Realtor based on recommendations from my friends, and she turned out to be a real sweetheart. She gave me access to the MLS listings, I scheduled a trip to Phoenix, and right before the trip I picked out 20 houses under $150k that I wanted to see. My thinking was that I would look for a bargain since I was keeping my home in Kansas. So I show up in Phoenix, meet the Realtor and run into the first problem. All of the houses are gone in the two days between the time I picked them and I met the Realtor. Apparently if you don’t start in the $175k and up range, the houses are all going to the cash investors. So then I notice that every listing, no matter the price, is approximately 50% of its one time high. I decide I may just as well go up the property ladder, right? After all, this is still America. Land of the free (and easy credit). I raise the limit to $300k and all of a sudden I can go shopping for houses.

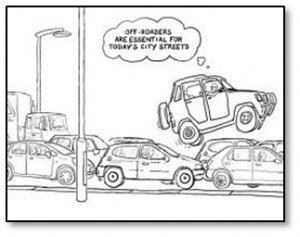

I schedule another trip, and after three harrowing days of traveling in my Realtor’s Chevy Suburban to look at houses, we pick one. I think all Realtors drive like Bonnie and Clyde leaving their local banking establishment after an emergency withdrawal. This one also added in looking at MLS listings while driving, working two phones at the same time and making U-turns as desired. It didn’t help that we had to dodge a plethora of Canadians who are trying to dominate the local real estate market. So we survived that, put in an offer on the house at $10k under its listing price of $230k, have the offer accepted, and then the “stuff” that is the heart of this story begins.

I schedule another trip, and after three harrowing days of traveling in my Realtor’s Chevy Suburban to look at houses, we pick one. I think all Realtors drive like Bonnie and Clyde leaving their local banking establishment after an emergency withdrawal. This one also added in looking at MLS listings while driving, working two phones at the same time and making U-turns as desired. It didn’t help that we had to dodge a plethora of Canadians who are trying to dominate the local real estate market. So we survived that, put in an offer on the house at $10k under its listing price of $230k, have the offer accepted, and then the “stuff” that is the heart of this story begins.

I decide I am going to pay 20% down for the house, get a loan and take advantage of the dirt cheap rates (3.75% for a 15 year fixed at the time). So I have a bank in mind to make the loan. The Realtor gets a puzzled look on her face and says she really isn’t sure how to do that. All sales in this area go through brokers/loan agents. She had been in the business forever and never worked with a bank. And of course she has a broker she “works with.” And a handyman. And an inspector. And an insurance agent. And an appraiser. I mean this is serious one-stop shopping. So I am like, well if they can meet the same loan rates as my bank and it will speed up the process, no problem. Maybe that was a bad decision. I fill out the loan docs, put down my financials, send them in and get a quick response. My loan is going to be approved subject to “additional documentation.” Oh, did I tell you this was a Fannie Mae foreclosure? That means I have to use their selected title company to get discounted title fees.

Then I start to get bombarded with requests for information from the lender. Not the typical W2s, statements, etc. I mean really creative documents. Like they want a check stub proving that I paid my 2011 taxes when it is only February of 2011. Then they wanted a W4 that showed I had moved to Arizona. Which brings up a great question: who is going to relocate to another state before they buy a house? They want a copy of every paycheck and a bank statement every week from the loan app until closing. Did I mention that my bank doesn’t give out weekly bank statements? And then there are my personal favorites: the documents they didn’t ask for, which include any of my retirement accounts, deposit accounts, or documentation that I owned another house.

So being in banking since the ’80s, at some point I have to ask the broker/loan agent what is up with all the crazy documentation requests? With my credit rating, down payment and assets, why am I being asked to do this? The responses are somewhat revealing. Many of these were related to me with lungs wide open:

- In a post financial meltdown world, the lender trusts no one.

- The loan processing agent/underwriter is Queen/King for a day. She/he decides what to request, whether to approve the loan, and the loan agent has no say. Period.

- The lender is scared to death that he/she will be forced to buy back the loan so they want to show they have done their homework.

- They won’t use assets they don’t need to get the loan approved. It just increases their work. They select the assets you have to put on the loan app and they verify those.

- The underwriter is just guessing at who is going to buy the loan or what the purchasers of the loan may push back on.

So I stay the course through more adversity than you can imagine and close on the house. I take possession and note that my house has been sold to Bank of America before the first week is out. I am now making payments to someone I don’t know and never will see and would never have gone to for a loan.

And then everyone wonders why real estate is dragging. It’s not the supply and demand. There is plenty of supply, and while our capitalistic society isn’t perfect, I think there is still demand strong enough for a buyer and a seller to get together. It’s this stupid lending process. A National Association of Realtors’ survey found 15% of real estate agents said their last contract didn’t close because the buyer couldn’t get a loan. If one contract doesn’t close, it often drags another contract or more down with it. The Federal Reserve is now saying that lending is getting too tough. But from my point of view it wasn’t the traditional lending standards, i.e. loan to value and ability to pay, that were too tough. It was the lending process. No one ever questioned my ability to pay. They were questioning my ability to PROVE I COULD PAY to the person they were guessing they would be selling the loan to.

Other observations from the buying process:

Fee Generation

- My Realtor (for three days of crazy, crazy driving and continually talking me off the ledge during the loan processing): $6,600

- Fannie Mae’s Realtor (for doing nothing): $6,600

- Title Insurance/Settlement (for losing my deposit twice, costing me $114 in wire fees at my real bank): $1,216

- Appraiser (for hitting the exact target that Fannie Mae wanted for the house): $395

- Lending Agent (Harassment fees): $1,465

- Inspector (who forgot to tell me I was in a flood zone on the side of a mountain in Arizona): $425

- Insurance (who signed up the insurance for the wrong address for somebody with my same name): $1,308

- Credit Report (so when did they start charging the lender to pull his own credit report?): $60

Loan Doc Processing

- Wired my earnest money with the offer. The title company immediately wired the money back and said I had missed the processing cutoff. Apparently they want you to have some sort of time machine that gets them the earnest money prior to making an offer.

- All closing docs had the wrong closing date.

- All loan and closing docs had the wrong address.

- No HUD-1 estimate was ever correct.

- The closing agent actually tried to pressure me into not reading the documents during the signing process. The abuse actually worked on my wife who was then pressuring me to not read everything. Hell, it’s only a quarter of a million. Why read what you’re signing?

We have got to get trust back into the process. If we are going to ask for deposits on a trust basis, but do loans on a total adversarial basis, then our industry isn’t going to be the same as the one I grew up in.

You can’t make this stuff up. Let’s not be so sure that our customers don’t have similar complaints. We can do better as an industry.

Have a very Happy Thanksgiving. For what it’s worth, I love my new home.

-br