It happened this week: Fintech Meetup, one of the newer trade events that brought 4,000 or so fintech and banker types to Las Vegas.

The striking thing about the conference was not the magician hired to walk around the booths during Monday’s reception or the illustrator seated right next to a sign created by artificial intelligence on Sunday’s welcome gathering, it was the event’s meeting pit: a section in the exhibit hall that was dedicated to taking short meetings that the mobile app assigned you to ahead of the conference. The experience felt akin to entering a mosh pit but instead of musicians, you are in it with bankers and entrepreneurs and there are chairs.

The speed dating meetup setup helped contain what would have otherwise been overwhelming with so many attendees. From panels to keynotes to hallways, here are a few things that caught my attention:

AI: Next-gen customer experience?

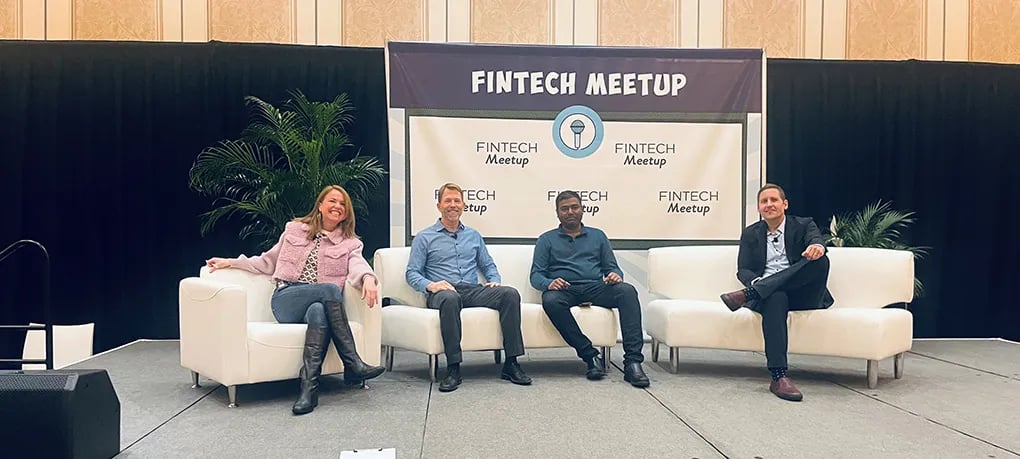

Mary Wisniewski, Editor-at-Large, Cornerstone Advisors (Moderator); John Spottiswood, Chief Operating and Data Officer, Jerry; Srinivas Njay, Founder & CEO, interface.ai; Ryan Hildebrand, EVP, Chief Innovation Officer, Bankwell

The issue of customer service came up on repeat in my panel exploring artificial intelligence and customer engagement. Srinivas Njay, founder and CEO at interface.ai, made a bold prediction: Njay believes we’re not too far away from asking the human for the bot instead of vice versa.

While it feels hard to imagine that scenario when I still shout “arghhhh” to try to con the bot to bump me to a human agent on a call, his prediction highlights something critical to the 14% of banks that said they plan to invest in or implement generative AI this year (per Cornerstone Advisors’ “What’s Going On In Banking” report): When is the right time to escalate an issue from bot to human (or in the reverse)?

On the panel, John Spottiswood, chief operating and data officer at Jerry, recommended that businesses favor escalating the issue to humans early, then in time, expanding the bot’s ability to respond to consumers with concerns. For example, Jerry, an automotive app company, has a testing system that Spottiswood said saves hundreds of different questions with acceptable responses from the large language model (LLM). Then, Jerry runs a test against the new prompt version to make sure the bot continues to spit out the right answers to questions it could answer correctly in the past before it launches a new version of the LLM to production. He likened it to regression testing.

What’s at stake is the quality of service, determining whether customers are satisfied, angry, or at least in one case, happy.

In case you missed it (as I did): In December, an auto dealer that deployed a chatbot found itself in a pickle. The dealer’s bot accepted an offer of $1 for a 2024 Chevy Tahoe. It wasn’t the only auto dealer with similar chatbot issues. Lesson (maybe) learned: Mind your scripts.

Two AI tools in the wild:

- Bankwell, a Connecticut bank, is piloting an AI tool to help small business owners apply for loans at whatever time works for their busy schedules.

- Xero, an accounting technology provider, now offers a chatbot for small businesses.

Distribution, distribution, distribution

The quest to scale a fintech company while maintaining high-quality business models came up on repeat. Some attendees see AI as a real way for fintechs to grow at a reasonable cost structure.

Panelists urged developers to go where customers have the biggest needs. This shouldn’t be a new concept to bankers or entrepreneurs. But it highlights something ever more pressing to fintech companies across the world: how to achieve scale without spending significant amounts of money. NuBank, for example, got a shoutout for acquiring customers at an eye-popping $5 per customer.

On a separate track, Ryan Budd, head of financial services at Cash App, pointed out that building trust takes time. “Gradually build trust with different products,” he said. An aside: He said not to call Cash App a super app but a “one-stop shop for financial services.”

Observations from others on the topic:

- Of interest: Using employers to distribute fintech services, such as by startups partnering with them to offer employees early access to their wages.

- Scaling through community banks and credit unions is, of course, another move plenty of fintech companies seek.

- “BaaS platform providers are FAR from dead,” as our own Ron Shevlin writes on LinkedIn.

- Beanstox Chairman Kevin O’Leary said it was looking for a bank partner at the conference.

Gen Z and improving financial outcomes

Among the intriguing credit union-fintech pair-ups is Michigan State Federal Credit Union’s endeavors. The innovative institution, which attended the conference, is working with several fintech startups in its pursuit to acquire young members: Debbie (savings and paying down debt app) and Tandem (a couples money tool) are among them.

Frich is another early-stage startup courting financial institutions to help them acquire young customers. I am most struck by its pursuit to help users see how much their age group spends on something like a date or on rent.

We’ve seen a feature exploring this idea before. Status Money lets its users compare their spending trends. While it flamed out as a startup, this feature idea is compelling when you consider just how popular stories on how people spend their money are. Refinery29 made this concept famous with its Money Diary Series. But do not miss this published on Bon Appetit: What a 45-Year-Old Orchestra Conductor Making $950,000 Eats in San Francisco. It’s financial voyeurism, and Gen Z especially likes it.

Older adults – the vast majority of our country – need better banking options. But ditto for younger people. As my colleague Tony DeSanctis wrote on a LinkedIn post: “While the focus on the over 65 population might make sense short-term, the clear long-term opportunity is making sure you are relevant to the younger demographic. They may be smaller in size but perhaps more well-off once the transfer of wealth happens.”

Optimism: True or fake

Optimism of fintechs flourishing was among the prevailing sentiments at the conference. But it also was last year, ahem, right after the Silicon Valley Bank run. There’s often a remarkable difference between what you say out loud and what you feel inside.

If you missed Jason Henrichs and Alex Johnson’s new Breaking Banks podcast segment called “Killing it,” don’t. The podcast series digs into the horrors that entrepreneurs experience while trying to build financial products, something Henrichs experienced firsthand. When he said he was “killing it” at his old fintech startup, he meant it in a literal sense.

As Henrichs posted on LinkedIn:

“I faked my own smile.

Perkstreet was a pioneer in BaaS / neobanking / whatever you want to call it.

Like many pioneers, we ended up on the side of the Oregon Trail with dysentery.

I didn’t just lose a company, I lost:

💣 My identity

💣 My confidence

💣 My self-worth

It was a long journey to recover those things.”

Our deep applause to Jason for bringing this critical issue more to the surface.

Bottom line: The whirlwind trip confirmed one thing: The appetite for fintech is alive and well.

Extra credit reading:

- Banks Need Artificial Intelligence – It’s Just a Matter of Picking the Right Technology

- The Newest Neobank is for the 62+ Crowd

Mary Wisniewski is editor-at-large and director of content at Cornerstone Advisors. Follow Mary on LinkedIn.