While growth and scale are helpful, bank leaders need to dive deeper into enterprise performance data to uncover the smart efficiency opportunities.

Well folks, they’re back—the cries from the rooftops, in the media and at conferences that “Scale Matters” in our consolidating and technically transforming banking industry. A recent round of bank merger announcements and the marquee Capital One/Discover deal illustrate this mantra’s popularity. It appears nothing else matters but the urgency to get big and get there fast.

It’s very hard for regulated banks and credit unions to gain any meaningful efficiencies under $1 billion in assets. Cornerstone believes the bulk of the 7,000+ institutions that fall below the $1 billion mark will be consolidating fast through this decade.

But let’s call time out for a minute. While it is factually true that the average efficiency gets better as organizations reach greater asset tiers, these averages gloss over the fact that there are great winners and pure dogs across all asset sizes.

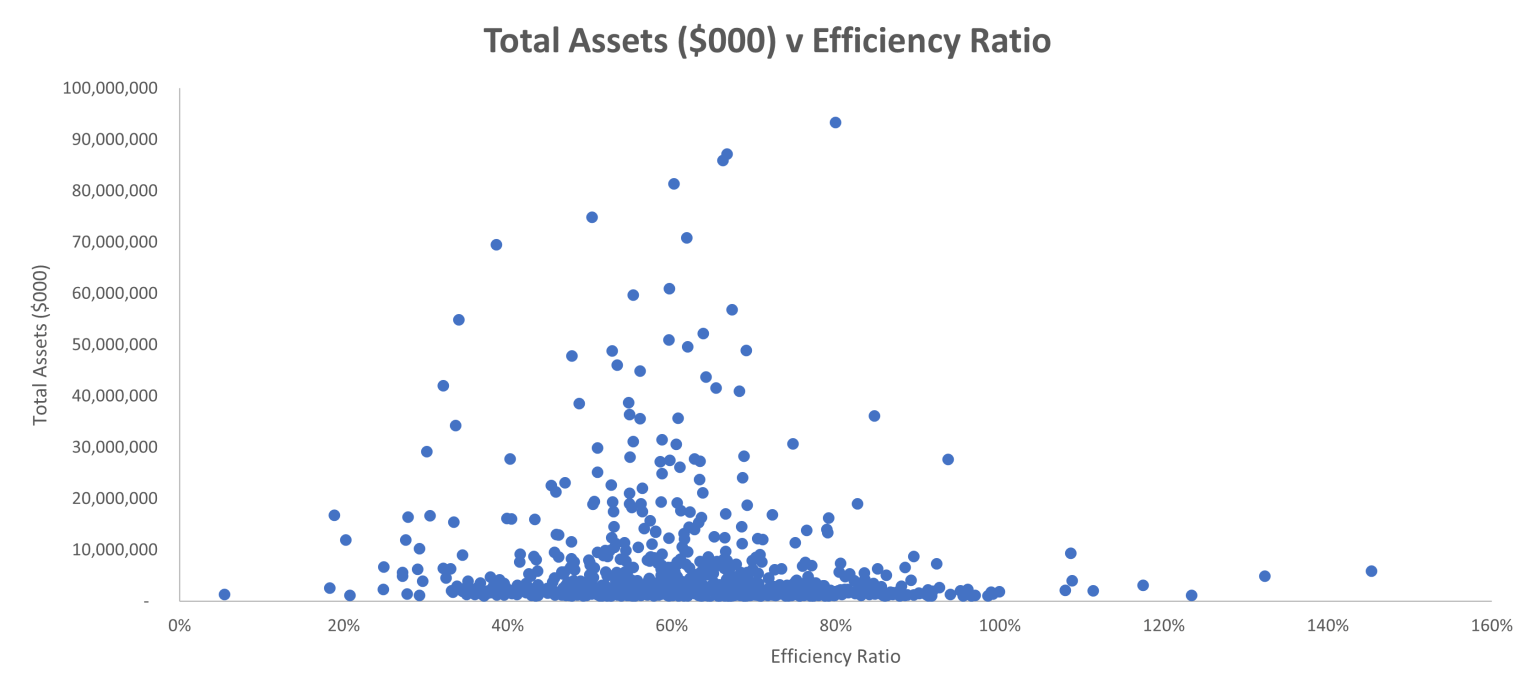

To provide a glaring illustration of this, Cornerstone data whiz Von Sowards analyzed all banks between $1 billion and $100 billion and plotted asset size versus efficiency ratio. Well fellow Gonzobankers, here’s the brutal truth:

As one can see, these data do not simply bunch up and to the left as our industry mantra about scale would imply. In fact, for the statistics geeks the correlation coefficient or “R” here is a measly .0018! There are banks with a few billion in assets running with better efficiency ratios than banks with $50 billion in assets.

At Cornerstone, we wave the flag not for being a scaled bank but for becoming a Smarter Bank—a dynamic organization that puts a traditional bank, a fintech and a top-talent workplace in a blender and comes out with a modern organization that is differentiated, hyper-efficient, nimble, data-driven and opportunistic.

So, while growth and scale are helpful, bank leaders need to dive deeper into the key areas that will drive a new frontier of smarter efficiency. Digging into enterprise performance data can help executives focus on where the smart efficiency opportunities lie. Here are five key areas that Cornerstone would encourage management to start:

- Digital Self-Service Utilization – Many bankers are feeling confident they are catching up to the competition in the digital banking experience, but very few have exhausted the sheer productivity benefits of widespread digital self-service. Simply put, there are still way too many loan payments, check deposits, account maintenance and inquiries being handled by branch and contact center staff.

Most banks haven’t taken the step to quantify this cost drag, and only a few are executing intentional strategies and campaigns to drive stronger self-service utilization. This is an area where the buzzword AI and well-designed usage of virtual agents can be a significant part of service activity redirect. - Digital Sales and Onboarding – Banks are still opening most new deposit accounts through branches and in-person bankers versus the digital channel. Meanwhile, national players like Bank of America have achieved 50% penetration of digital sales in their consumer bank, and digital-only fintechs/challenger banks are gaining 47% of new consumer accounts according to Cornerstone Research.

Management must invest in the resources necessary for best-in-class digital sales capabilities, and then they need to terrorize their team to hit aggressive growth goals through this channel. Without this push, traditional banks may lose a terminal amount of future market share. - Management Bloat – Banks need to take a hard look at the amount of compensation that is centered at the top in administrating managers versus individual contributors or true entrepreneurial leaders.

An exercise Cornerstone likes to conduct: Take a look at the top 20% of the bank’s headcount and review comp and bonus in descending order. As a trusted executive team, talk through what type of “ROL” or return on leadership the priciest folks in the organization are working. - Tech-Savvy Workforce and “EX” – Cornerstone has a client who memorialized their goal of building a tech-savvy workforce right into the institution’s vision statement. Why is this important? Because the productivity difference between a technically proficient worker and a neophyte is not 10% better, it’s 10X better! As banks invest in new lending, analytics, risk and CRM systems, leaders need to be demanding jerks and insist that all team members use the darn tools and realize the benefits of workflow automation.

At the same time, every system and process deployed at the bank must prioritize a simple and friction-free employee experience or “EX”. No tech-savvy Gen Z professional is going to stay long at a place with green screens, fragmented systems and tribal codes to remember. Overengineered complexity can kill the potential of tech-savvy workers. - KPI and Incentive Alignment – As legendary investor Charlie Munger famously quipped, “Show me the incentive and I’ll show you the outcome.” Highly efficient banks typically work to build very transparent key performance indicators and benchmarks across all departments, and they tie performance metrics to the wallets of the professionals charged with attaining these goals.

In the age of cloud-based data platforms connected to powerful analytic and AI tools, there is simply no excuse for leaders not to create strong alignment around metrics, performance and pay.

So, let’s do a quick thought experiment, Gonzobankers. Imagine if a group of investors built a brand new Smarter Bank using all the new tools available today: cloud technology, digital-first delivery, data and workflow integration, AI-infused tools and systems, connected ecosystem partners, agile execution approaches and workplace best practices. What would this institution’s potential efficiency ratio be? Sub 40%?

As industry consolidation continues, scale will be part of the future story, but smart ultimately wins the day.

Steve Williams is founder, president and partner at Cornerstone Advisors. Follow him on LinkedIn.