PayPal Pivots in Response to Heat from the ‘Pays’

Are mobile wallets a threat to PayPal’s online payment dominance?

In the past two weeks, PayPal has signed agreements with Chase, Citi and Bank of America, in addition to expanding its deal with Visa to issue Visa debit cards in Europe. Pretty dramatic shift in strategy for a firm that not so long ago threatened to challenge the existing world order in payments, no?

This strategic shift — what I’ll call the PayPal Pivot — is the result of PayPal seeing the threat of mobile wallets to its online payment dominance. Mobile wallets from players like Visa, MasterCard and Chase build upon a strong base of scale and platform, while wallets from firms like Apple, Google and Samsung are tightly integrated into consumers’ mobile behaviors.

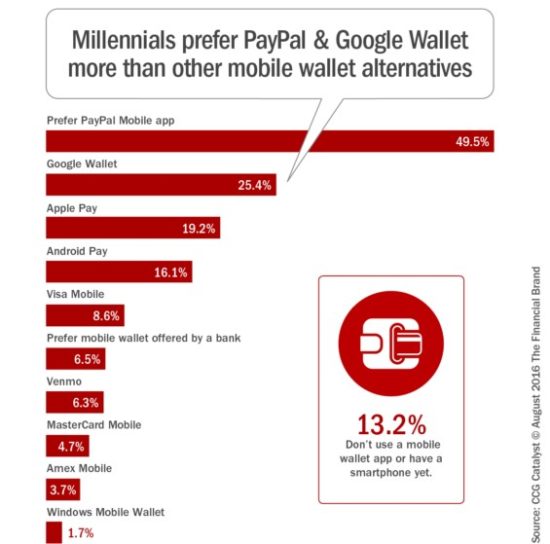

What’s ironic is that not long ago, PayPal was listed as the most popular mobile wallet among Millennials. Even PayPal execs laughed at this (in their offices), knowing that they didn’t even have a mobile wallet offering at the time of the survey. But the mobile wallet market has matured rapidly in the past 12 to 18 months, and PayPal is feeling the heat from the “Pays.”

At the heart of the Pivot is PayPal’s bet that the future of payments — both online and in-store — is digital payments.

With the advent of mobile wallets and the rollout of near-field communication (NFC) terminals as part of the Europay, Mastercard and Visa (EMV) upgrade cycle, PayPal recognizes the need to deliver a mobile wallet solution that can be used for both online and in-person payments to drive customer growth.

PayPal has significant market share in digital payments (some sources put it at more than 70%). But the advent of mobile wallets for in-person payments has created viable alternatives to PayPal for online transactions. The growing number of consumers who use Apple Pay or Android Pay in-store may shift their online payment behavior and rely on those tools to buy online, displacing PayPal as the online payment method of choice.

PayPal can’t afford to lose its dominant position in the online space and is in the process of rolling out a mobile wallet that will be its online/offline solution to compete with the Pays.

Mid-Size Financial Institutions Must Pivot, Too

Mid-size banks and credit unions, on the other hand, can’t afford to miss out on this evolution. Financial institutions that cannot position themselves as the primary card provider — offering PayPal, Apple Pay, Samsung Pay, Visa Checkout, and every possible online and recurring merchant’s pay offering — run the risk of losing significant transaction volume over the next five years.

As a value proposition, “Free checking!” just doesn’t cut it anymore. If the megabanks compete on scale, and the mega-tech firms compete on integration, mid-size FIs must find their basis of competition.

Financial health and well-being will be the basis of competition for mid-size FIs.

Looking out for the best financial interest of consumers is something the tech firms can’t do, and the megabanks aren’t set up to do.

This is one instance where regulatory requirements, fraud management, and other risk-based activities can be positive differentiators. Financial institutions are held to a higher standard, and this provides peace of mind and confidence in the safety of a customer’s money. Safety and security is already a key part of what financial institutions do every day and should be reinforced in marketing efforts.

Mid-size FIs can differentiate by helping consumers measure and monitor their financial lives. What are they spending, how are they spending, where are they in their financial life cycle? Fintech startups are offering tools and technologies to help answer those questions. Mid-size FIs shouldn’t wait for their core providers to come to the table with those capabilities — they’ll need to explore opportunities to collaborate directly with the startups.

As the world of payments evolves, financial institutions must maintain as much visibility into payments as possible, and leverage that to provide a holistic view of customers and their financial needs. Are you ready for this Pivot?

-TD