Retail Banking

call center

Best Practices

contact center

bank call center

credit union call center

credit union contact center

bank contact center

Optimizing the Contact Center in the New Normal

Time-tested best practices can help financial institutions stay agile in the face of COVID-19.

The effects of COVID-19 for mid-size banks and credit unions will be wide-ranging, and the repercussions are not yet fully understood. One thing we know for certain, however, is that the role of the contact center is more pivotal than ever.

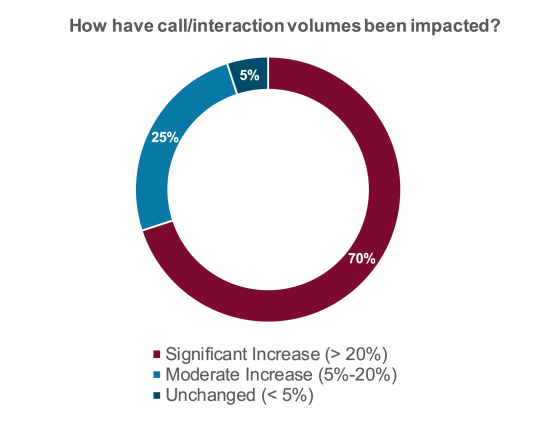

With myriad questions surrounding loan deferments, stimulus checks and the Paycheck Protection Program; severely limited branch access; and an influx of customers utilizing digital channels for the first time, contact centers are facing huge spikes in inbound calls. In a recent Cornerstone survey of bank and credit union clients, the vast majority reported increases of 20% or more as a result of the pandemic. Anecdotally, many financial institutions are facing volume surges much higher than that.

Since most mid-size FIs lack scale, struggle to maintain full staffing and keep up with volumes pre-C19, service levels have suffered mightily with average “Speed of Answer” (wait time) and abandon rates tripling or worse. Third party overflow call partners, which banks and CUs rely on to handle peaks in volume, are also overwhelmed, which has only compounded the problem.

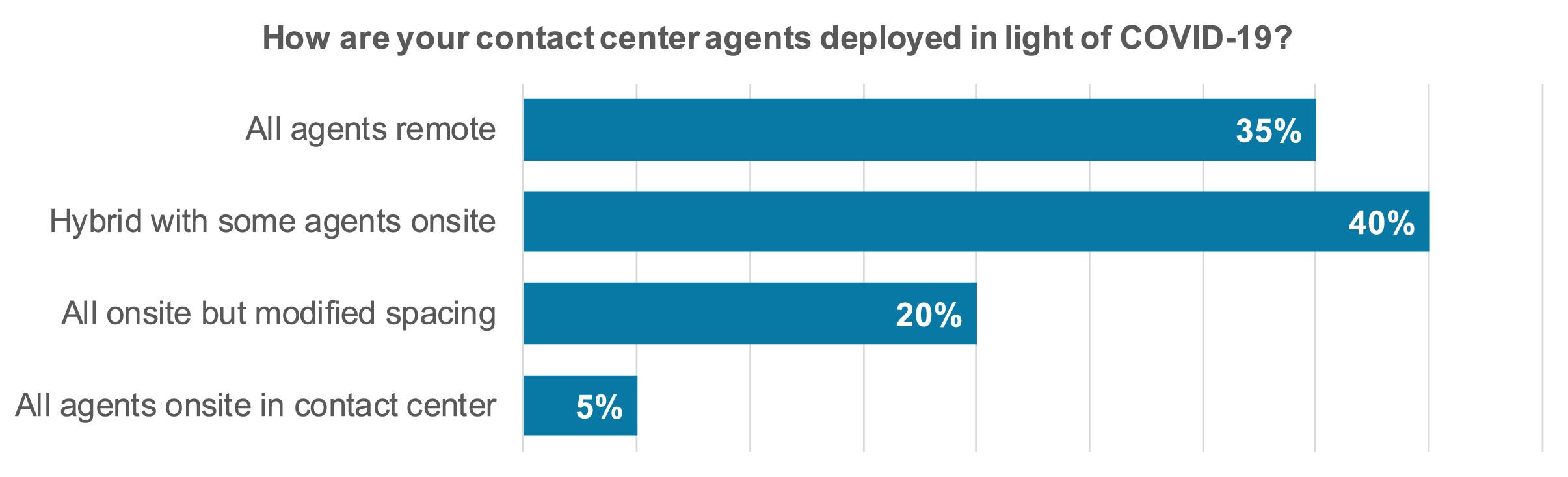

Amid unprecedented demand for remote support, contact center teams have also needed to adjust operations to conform with social distancing. With the help of highly caffeinated information technology professionals, most contact centers have overcome initial technology hurdles quicker than most anyone would have predicted. Responses have ranged from upping VPN licenses and deploying USB softphones to sending desktops and monitors home with agents due to a shortage of laptops. At least one client issued stipends for employees to spend at their discretion.

While working side-by-side was the norm just a few weeks ago (only about one in five contact centers supported remote workers prior to the pandemic), 75% of FIs report at least partial remote deployment now.

Banks and credit unions have demonstrated impressive adaptability in overcoming initial roadblocks. But huge uncertainty remains surrounding any return to normalcy, and contact center leaders face a slew of additional challenges to keep operations on track. With the initial triage behind us, high performers will stand apart from the competition by maintaining an unblinking focus on these fundamental best practices:

Maximize Technology Investments

The pandemic is a wake-up call for institutions insistent that a live person answer every call. Getting service levels under control will require fully leveraging available platform capabilities. This includes updating call menus; presenting relevant, automated information in front of the phone tree; giving customers a degree of control with call back options; and providing wait time announcements. Formalizing routing to internal escalation partners (i.e., loan servicing), who traditionally got by without structured queues, is also key.

Optimize Process

High performers will identify and eliminate inefficiencies resulting from manual maintenance processes, paper forms and logs, and cumbersome after-call procedures. If agents can’t do their jobs without a printer and fax machine, something’s broken.

Empower Agents

Removing bottlenecks that cause overly restrictive approval policies (e.g., fee waivers), inadequate system access (e.g., card travel notices) and lack of decision-making powers is integral to overall contact center efficiency.

Shift to Profit versus Cost Center

Support for loan and deposit origination by phone is now table stakes. Leading contact centers are also equipping agents with training and access to support applicants who started the process online but require assistance.

Rethink Authentication

Whether the pandemic will be a turning point for adoption of technologies like biometrics, one-time passwords and fraud scoring remains to be seen. It is safe to say it’s a good time to revisit and update authentication procedures (including step-up authentication for higher risk transactions) and to evaluate all available options to defend against criminals looking to take advantage of the crisis.

Engage Employees

Pressures on an already high stress role have been amplified. Clear guidance on evolving policies, incentives aligned with individual and team goals, and frequent communication (while avoiding micromanagement) are all key to maintaining productivity and morale. Strong quality control processes with clearly defined criteria and timely feedback to agents are essential.

Measure Progress

Accurate and granular management reporting including volumes, call drivers, handle time, agent adherence and service levels to drive informed decisions is the underpinning to all other aspects of high performance.

Don’t Forget the Customer

It’s easy to lose sight of the customer experience in the midst of everything going on. As we move fast on necessary process and policy changes, taking a step back to consider the customer perspective will be critical.

The COVID-19 pandemic represents an inflection point. With decisive leadership, disciplined adherence to time-tested best practices and agility in response to rapid change, contact centers will emerge even more resilient and well-positioned for whatever the “new normal” looks like.