GonzoBanker’s Post-Pandemic Customer Care Playbook

Transform your customer care function from a back-office cost center to a 21st century competitive advantage.

The COVID-19 pandemic permanently changed consumer banking preferences. Over the past year and a half, customers learned that although they may have been mandated to stay at home, they did not have to accept being told how to do their banking.

As providers like Amazon, Netflix, and Instacart showed consumers that they could easily conduct business from the comfort of their living rooms, it fell on financial institutions to step up their game and deliver virtual services that are consistently quick, simple, and personalized to customer preferences.

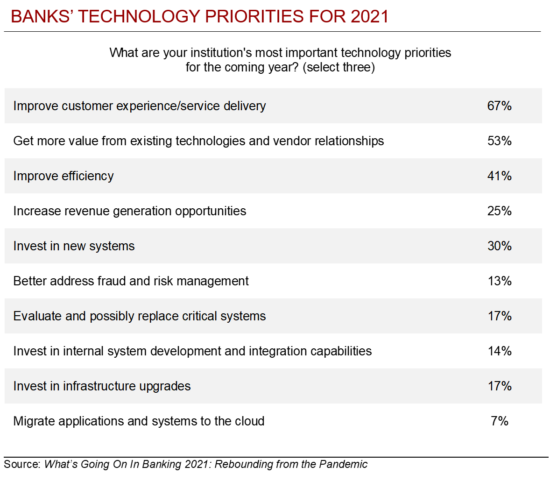

So hats off to executives at community-based institutions who, according to Cornerstone Advisors’ What’s Going On In Banking 2021 study, said improving customer experience and service delivery was their No. 1 technology priority for 2021 – ranking it considerably higher, even, than boosting efficiency or increasing revenue generating opportunities.

Further, this same study found that out of 27 systems, call center and customer relationship management (CRM) platforms both ranked in the top 10 by banks for systems slated for purchase or replacement this year.

A robust customer care function has never been more important. Here we share highlights from the GonzoBanker Customer Care Playbook, designed with your success in mind.

People

With the increase in digital adoption, the demand for live agent support is stronger than ever. Today’s agents are resolving lengthier and increasingly technical issues, and turnover remains a fact of life in even the very best-run operations. The cost, both direct and indirect, of attrition is high. These tips can help executives manage – and keep – the people so critical to customer care.

Playbook Highlights:

- Build a talent machine. Excellent customer service is delivered by professionals with a rare mix of people and technical skills and poise under pressure. As a result, contact centers will face the challenge of “good” turnover (employees accepting positions across the bank). High performers will focus on building a repeatable talent playbook: career-pathing, mentoring, recognition, and variable compensation aligned with performance and quality measures.

- Upgrade workforce planning capabilities. The pandemic-fueled surge in volumes will surely stress the Excel-based model built years ago to the point of failure. Leverage workforce optimization tools to reduce the administrative burden of scheduling and to proactively understand future staffing needs.

- Embrace remote work. Employee expectations related to remote work have radically shifted, and customer care is no exception. Balancing employee expectations with the need for efficiency in a fast-paced, high-stress role is no easy feat. For most contact centers, a hybrid model makes sense (part remote work and in-office time for training, coaching, and team building). The exact “right” mix will vary depending on culture and productivity levels, but regardless of the policy, a deliberate focus on employee engagement is key.

Organization

Customer care teams find themselves in a Catch-22: they’re expected to resolve customer issues on topics ranging from incompatible browsers to card fraud to bill pay errors, but they are hamstrung by insufficient access and empowerment. Agents spend valuable time navigating manual processes, inter-departmental transfers, and sub-par policy and procedure documentation. Longer call times lead to higher abandon rates and call churn. As a result, internal morale suffers, and so does the customer experience.

Playbook Highlights:

- Empower agents to say “Yes.” Challenge “we’ve always done it that way” thinking and break down years of antiquated procedures and practices. Maintain a sharp focus on compliance and safeguards against fraud, but find the fast path to put the customer first.

- Optimize for first contact resolution. Clearly define topics that should be resolved by agents at the first point of interaction. For inquiries requiring escalation to a “tier two” expert, establish explicit guidelines and internal service levels. Utilize data to understand drivers of hold time and transfers, and tweak training, system access, and coaching with a focus on improved first contact resolution rates.

- Focus on the mission. Customer care too often becomes the de facto dumping ground for activities that other departments can’t or won’t do. Tasks like mail sorting and dispute processing, while important, divert critical agent time away from frontline customer service. FI’s need to inventory and re-align operational activities not in direct support of the primary objective of service delivery.

Technology

The sudden shift to remote work put the contact center technology at many banks under immense pressure. Thanks to hard-working IT teams and creative workarounds, most hurdles were overcome, but the pandemic underscored the functionality and flexibility challenges of legacy platforms. When operating at scale, knocking a few seconds off of average call handle time or eliminating a small fraction of inbound volume can translate to hundreds of thousands of dollars. Technology alone is not a strategy, but there is a solid ROI case for technology that enables exceptional service delivery.

Playbook Highlights:

- Know your customer before you talk to your customer. Introduce biometric authentication capabilities and advanced fraud defenses. When done right, the result is a trifecta of a streamlined verification process, reduced fraud losses, and improved customer experience.

- Modernize your contact center platform. Call center tech should be evaluated through the lenses of native functionality, simplicity of administration, and flexibility. Integration with CRM, core, data warehouse and other critical applications should be considered mandatory versus nice-to-have.

- Cut through the noise surrounding AI. Consider deploying process automation and conversational artificial intelligence (AI) technology to augment customer interactions and fulfillment activities. Understanding the resource investment (both up-front and ongoing) and return (incremental versus immediate payback) and starting with a narrow, well-defined scope will be critical to success.

Customer Experience

A common pitfall as banks grow is attempting to preserve the personalized, high-touch service that historically worked well without fully acknowledging the required trade-offs. As the old adage goes, “Choose two: speed, quality, cost.” Leaders must make the hard choices. Unfortunately, trying to be “all things to all people” often translates to an inferior customer experience.

Playbook Highlights:

- Up your service level agreement (SLA) game. Commit to service level targets and routinely report on performance and challenges. Tailor service level targets based on channel, group, and customer segment. Augment traditional service level metrics with systematized measures including customer satisfaction scores and AI-driven caller sentiment tracking.

- Put teeth in your CX program. Direct customer feedback is essential to assessing service quality. CX data must meet four criteria:

- Low friction: Don’t ask customers to complete a three-page, multiple-choice test. Ask one or two primary questions with follow-up if feedback is particularly good or bad.

- Timely: A 30-day lag in results is a deal-breaker. Aim for real-time or near-real-time results.

- Representative: Gather data across interaction channels and types. Using core transactions as a survey trigger may work for branches, but not for customer care.

- Actionable: Tailor questions to separate the experience from general brand or policy perception. Interaction-specific data should drive coaching and process design decisions.

- Redefine excellent service. For many years in banking, excellent service invariably meant talking to a live agent in mere seconds. As banks scale and interactions increase in complexity, that old model is not sustainable. Embrace thoughtful use of technology where human intervention is not feasible or sustainable. For example, automated call-back offered for longer-than-usual wait time and dynamic routing of interactions based on the customer’s relationship.

In a recent NCR survey conducted by The Harris Poll, 86% of U.S. banking consumers say they would be more comfortable with their financial institutions having access to their personal data than a big tech company such as Amazon, Apple, or Google.

Banks have long carried the critical burden of trust for consumers. Now, as they strive to remain competitive and gain efficiencies in the post-pandemic world, the leaders must not lose sight of the fact that digital transformation is driving new go-to-market strategies – and they’re behind the wheel.