Does Marketing Have a Seat at the Table in Your Bank or Credit Union?

Marketing needs to go beyond execution and make a more strategic contribution

The title of a recent Financial Brand article asks the question, “Are Financial Marketers Worthy of C-Suite Status?” The question insinuates something that many bank and credit union chief marketing officers (CMOs) would probably rather not admit to: That they (and their departments) don’t have a seat at the proverbial table in their organizations.

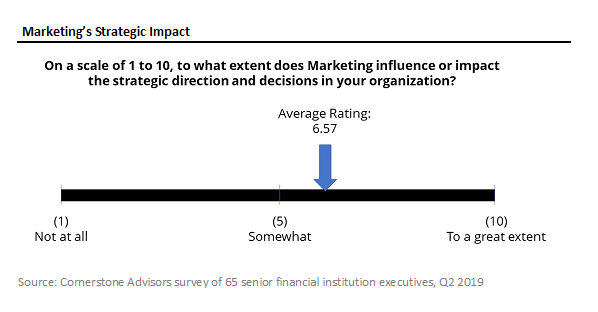

Marketing’s Strategic Impact

In a recent research effort, Cornerstone Advisors attempted to quantify the extent to which marketing departments in mid-size financial institutions are having a strategic impact.

Defining a methodology and approach for measuring strategic impact would be the preferred way to go about it, but in the absence of both time and money to do that, we conducted research that asked senior marketing executives how strategic Marketing is in their organizations.

The answer is “just barely better than somewhat.”

On a 10-point scale (1=not at all, 5=somewhat and 10=to a great extent), the average score was 6.57, with 37% of respondents rating Marketing’s strategic impact at eight or higher, 35% assigning a rating of five or six, and 28% assigning Marketing’s impact at five or lower.

Based on the responses to the strategic impact question, we created three segments of respondents: low-impact (score of five or lower), moderate-impact (score of six or seven) and high-impact (score of eight or higher).

Thirty-seven percent of respondents were categorized as high-impact institutions (with an average impact score of 8.54), 35% (with an average impact score of 6.57) were slotted in the moderate-impact group, and 28% (with an average impact score of 3.94) fell into the low-impact group.

Five Traits of High-Impact Marketing Departments

What distinguishes the high-impact institutions from the rest of the pack? We found five common traits among the high-impact organizations:

- Appropriate time allocation. The vast majority of all survey respondents believes their marketing departments spend the “right amount of time” on activities like budgeting, departmental staff meetings and direct mail campaign planning. But two-thirds of the high-impact institutions spend the right amount of time on corporate strategy development and planning in contrast to just 24% of other marketing departments.

- Strong internal relationships. All marketing departments work hard to serve their internal customers. But the high-impact organizations have strong relationships with other support departments like finance, IT and human resources.

- Strategic use of technology and digital marketing. Email might not be the most exciting technology in Marketing’s toolkit, but fewer than half of low-impact institutions say they’re making effective use of email in contrast to nine in 10 of the high-impact groups.

- Advanced use of data and analytics. Everybody talks about making better use of data these days, but the high-impact groups really do. And interestingly, their use of bill pay data for marketing purposes differentiates them from other financial institutions.

- Strategic planning for marketing. It’s hard to believe that not every bank and credit union has a written strategic plan for Marketing. But they don’t. A higher percentage of the high-impact institutions have one, however, and even though it might sit on the shelf like other plans, the process of putting the plan together helps them to be more aligned internally and with the rest of their organization.

The CEO Factor

Beyond the five traits of high-impact marketing groups, there is another factor influencing marketing’s strategic impact: The perspective of the CEO.

In three-quarters of the high-impact institutions, the CEO sees marketing as a “critical contributor to strategic decision-making.” In the low-impact institutions, just 6% of CEOs see marketing as a critical contributor—in most of those firms, the CEO views marketing as “important to the execution of tactical activities, but not particularly strategic.”

This is a classic “chicken and egg” situation: Is Marketing highly strategic and therefore the CEO sees the department as a strategic contributor, or does the CEO see Marketing as “not particularly strategic” and therefore Marketing is limited in its ability to have strategic impact?

Final Thoughts

The author of the Financial Brand article, Jim Marous, concludes that:

“It’s time for financial marketers to climb the organizational ladder. Getting a seat at the boardroom table in the C-Suite will depend on multiple factors. The most important transformation will need to be in the CMOs themselves.”

If we can quibble with Jim, we’d argue that transforming the marketing department is just as important a step as the personal transformation of the CMO.

For a copy of Cornerstone Advisors’ research report, Making Marketing Strategic, click here.